#1 has it's advantage

More debt = more power

Welcome to EC Research Group Newsletter

Previously the Why Alberta Now Newsletter

We’re moving to a new name to better reflect on my whys of writing these newsletters:

Sharing unique market insights you won't hear in mainstream media.

No jargon. Critical thinking. Connecting the dots in plain English. Know what others do not.

Empowering busy investors in less than 10 minutes.

Today I'm going to present a contrarian view for your consideration.

I do these thought exercises regularly.

It's a good way to challenge my views and question the bias I may have.

I'd like to invite you to explore this thought exercise together.

Even better, I'd love to hear your thoughts.

You can let us know your thoughts by replying to this email.

Feel free to scroll down to skip reading the background on US Government debt and jump to the thought exercise.

Conventional thinking and belief has taught us:

Debt = Bad

Of course, if one were to ask a business owner, entrepreneur, or investor, they will tell you:

Not all debts are bad!

The difference is consumer debt vs. business debt.

Consumer debt increases the cost of a purchase.

An iPhone used to cost $1,000.

When it’s financed over 2 years, the cost of owning the same iPhone is now $1,200.

Of course, a smart entrepreneur will say, if I can earn $4,000 more in income because of the iPhone, the interest cost of $200 is an investment resulting in $3,800 additional gains in income.

Spending $200 to get $4,000 is a good investment!

In this case, a good debt.

The size of Government debt is not the problem

The conventional belief is that when a government increases its debt, it’s bad for the country and its citizens.

That is a blanket statement similar to all Debt = Bad.

The reality is that debt is really not the problem.

It’s the growth rate that’s the problem.

If the US Government can borrow at 2% and grow at 3% every year, the country is getting ahead by 1% / year.

For the size of the US economy, that’s massive!

The past few years, the growth of US economy has been slowing down.

As an economy matures, it’s much harder to grow at a fast pace than it once was.

US interest rate has been slowly creeping up

The interest rate on the long term debt (Treasury Bonds, Notes) is determined by the market through supply and demand.

The supply in this case is the US Government.

The US Government offers investors to buy their debt.

Similar to any market, when there's the same amount of demand, the more supply there is, the lower the price.

In this case, the demand is coming from investors interested in buying US Government debt, and supply is the debt the US Government is selling on the market.

The lower the price of the debt, means the higher the interest rate.

Say it in another way, it takes a higher interest rate to attract the investors to buy.

Because now there's more debt to be bought on the market.

Interest rate and the Bond price has an inverse relationship.

Debt and interest rate for an average person

If we use a person in debt, Poor Joe, as an example, it's easy to understand.

When someone has maxed out their Line of Credit, if they don't want to cut down on their spending, they may start using Credit Cards to finance their spending.

We all know that Credit Cards typically carry much higher interest rates than a Line of Credit.

After their Credit Cards are maxed out, they then move onto using Pay Day loans.

The interests and interest rate Poor Joe pays increases as he keeps on increasing his spending.

This is what the US Government is getting itself into.

The cheaper debt option is now running out, so the interest rates are climbing higher to compensate the increase in debt load.

If the US economy can grow faster than the interest rate, then it's not a problem

It's not impossible, but it's a tall order.

For the size of the US economy to grow faster than 4-5% (the current interest rates for 1 year to 30 year Treasuries), it's going to be quite the challenge.

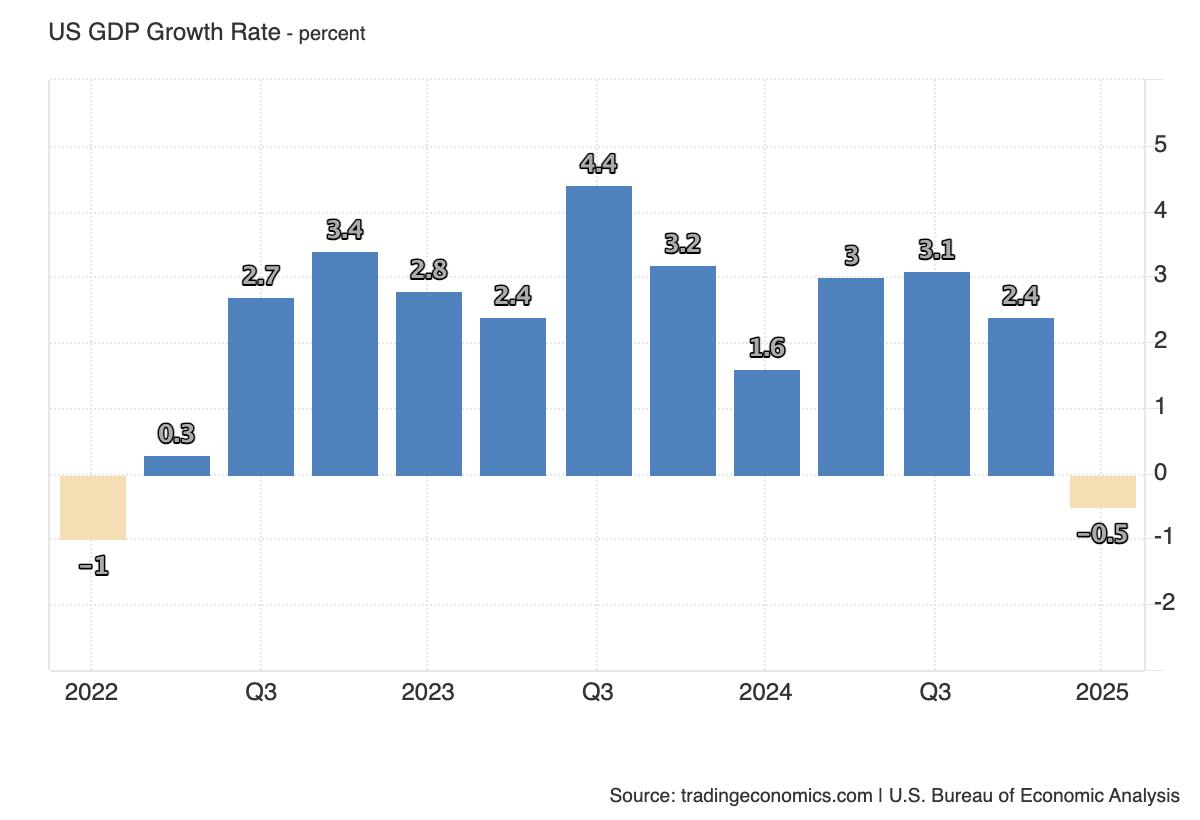

For the past 3 years, the US GDP has been growing at a rate between 2-4%.

Credit: https://tradingeconomics.com/united-states/gdp-growth

That means, like our Poor Joe example, the US Government is getting caught deeper in the debt spiral, which means even higher interest rates to come.

But here's the kicker: What if having more debt means less money for the little guys?

The question I asked myself is this:

Given the US is still the world's #1 power and the US Treasury remains the safest investment, as the debt continues to increase, the interest rate also increases.

That in turn, attracts more investors because who doesn't want to earn a higher return from the "safest investment" in the world today?

I put the "safest investment" in quotation marks to emphasize the irony.

The more capital that flows to the US debt, the less capital there is on the market for developing countries to sell their debts.

Those countries will either have to pay a higher interest rate, or run the risk of not getting enough funding as their debt don't get fully subscribed by the investors.

The higher the interest rate a country has to pay, the more it costs to borrow.

Which creates stress on those countries’ finances.

Further impacting their future growth.

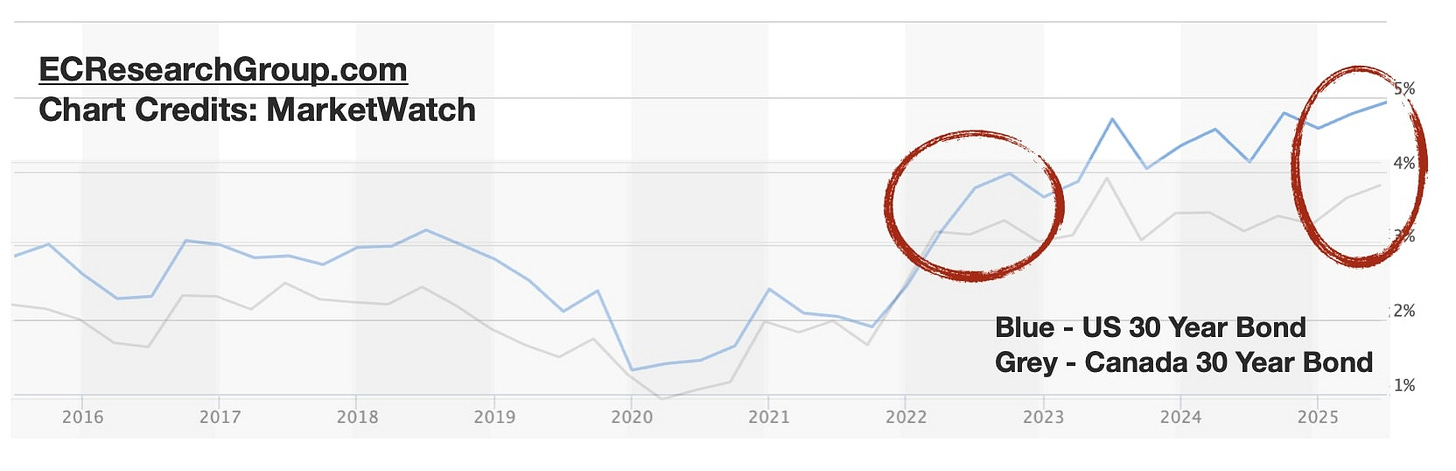

The rate increase in US debt may be starting to affect Canada's rate

The interest rate on the Government of Canada 30 Year Bond diverged from the US in 2022.

It made sense because the Canadian economy was struggling while the US economy was humming along.

In 2025, the interest rate on Government of Canada 30 Year Bond started to go up alongside the US 30 Year.

This may be following the historic trend of both countries staying in sync relatively closely.

You can see the pattern on the charts for the past 10 years.

However, what stood out to me in 2025 is the difference between Canadian economy vs. the US economy.

As of year to date, the US economy seems to be stronger than many had expected.

Even with signs of slowing, the data is showing it's still holding up well.

Much better compare to the Canadian economy.

If the Canadian economy is struggling more than the US economy, one may expect to see the 30 Year interest rate for Government of Canada to drop further.

Yet, so far this year, the Canadian Bonds are being pulled up alongside with the US.

I suspect it may have to do with the market demanding a higher interest rate on the US and in turn looking for the same in Canada.

Playing the last man standing game

If this is indeed happening, smaller countries like Canada could be forced to play the last man standing game with the US.

In that case, there's only going to be 1 winner.

Which is the 800 pound guerrilla, the "safest investment", the US Treasury.

If this happens, the US could pull ahead than many countries, which further creates a divide in investing in US Treasuries vs. any other government debt.

For the sake of the thought exercise, I'm overly simplifying a lot of things here.

The global Government Bond market is complicated.

But the big picture thought exercise is worth considering.

This is in contrary to the conventional wisdom that more Debt = Bad.

The situation may now be:

The more debt the US has, the more power it gains…

Until the day US Treasury looses the status as the world’s safest investment.

Your thoughts on this thought exercise?

Reply and let us know

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

July 8, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.