Alberta's boom for the next 10 years

Yup, I'm still bullish

On February 12, we’ll be releasing my 2026 Economy & Market Predictions. You can register with this link below:

If you have been reading our newsletter for a while, you will remember we started this newsletter under the name Why Alberta Now.

I started the newsletter with a very specific intention.

I wanted to track what I believed was an upcoming boom in Alberta’s economy and real estate markets.

About a year into writing, I realized something.

A newsletter centered only around Alberta was becoming too limiting.

Personally, I am a macro guy.

I have a deep interest in geopolitics, the global economy, and the big trends forming quietly on the horizon. Connecting the dots, spotting patterns early, and understanding where the world is heading before most people see it, that is what excites me.

That same passion is what led me to hosting my annual Market and Economy Predictions.

If you are interested, we are hosting two sessions this week.

You can check them out here:

https://luma.com/3w8rdwj9

Today, let’s revisit the case for investing in Alberta.

It has been a while since I wrote specifically about Alberta.

A quick introduction if you are new to our newsletter

Hi there, I’m Eric.

One of my businesses is in real estate asset management, focused primarily on the Alberta market.

We currently own and operate real estate in three different cities across Alberta.

Our approach is centered around acquiring or developing multi-family residential assets.

We look for value-add opportunities.

This often means buying older, run-down properties and repositioning them through renovations and better management.

In addition to value-add acquisitions, we also do multi-family infill development.

After the assets are renovated or fully constructed, we manage them as long-term rentals, providing housing for the working middle class.

Depending on where we are in the market cycle, I focus on matching market trends with the best strategy to capture the upside for our investor partners.

We pick real estate because it is an asset class I find attractive for building wealth and generating steady, consistent returns over the long term.

Just because I have not written much about Alberta lately, it does not mean I am not bullish

Real estate always comes back to two core drivers.

Jobs and population growth.

The outlook for both in Alberta remains very strong.

Even though the next couple of years are likely to be sluggish across Canada, Alberta is positioned to “lead” the way.

I put lead in quotes because it will not be as explosive as what we experienced over the past two to three years.

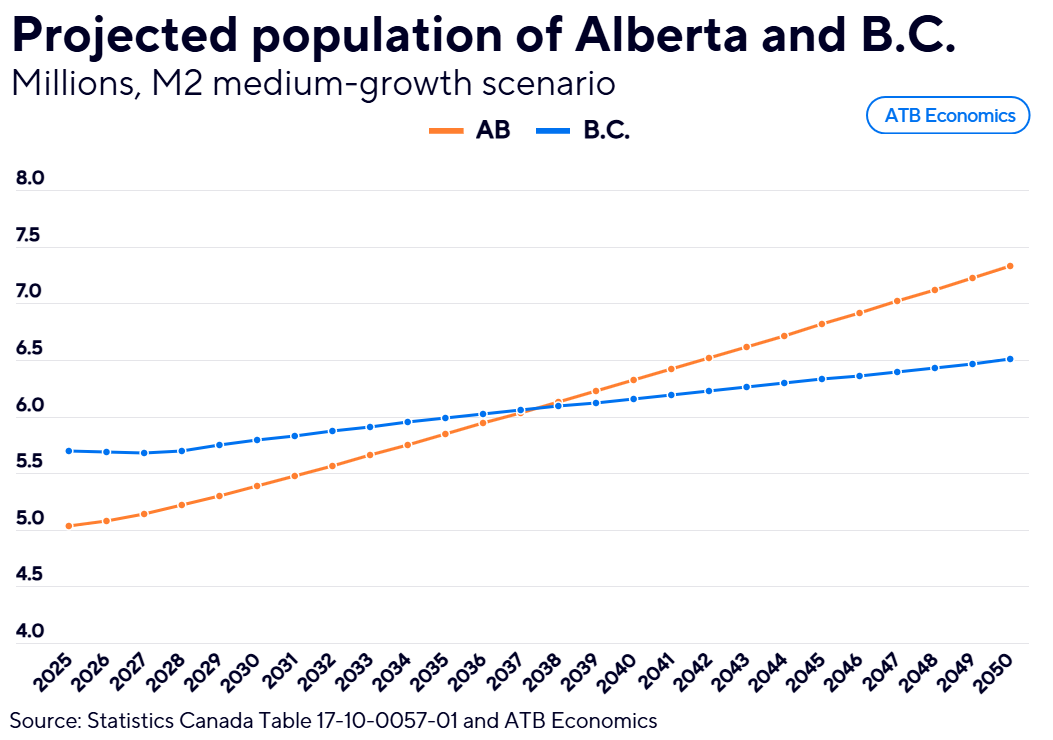

Take a look at these population projection charts from ATB Economics.

Zeroing in on Statistics Canada’s “M2” medium-growth scenario, Alberta’s population grows from about 5 million residents today to over 7.3 million in 2050. At 46%, Alberta’s population growth over the projection period is the highest of any province with the national population growing by a more modest 17%.

Source: ATB Economics

While growth has slowed from the peak years of 2023 and 2024, a 46 percent long-term growth rate is still more than double the national average.

What makes this even more interesting is that this growth is happening without the massive immigration surge we saw in recent years.

At some point, Ottawa will have to increase immigration again.

Baby boomers are retiring at a record pace. We will need more people simply to replace retirees and sustain economic activity.

Meanwhile, the job market is continuing to lead in Alberta compared to the rest of Canada.

Time frame model of investing

Most investors focus on asset class or annualized ROI.

We have previously written about how highly successful entrepreneurs view their portfolios differently, through a time frame model:

https://www.ecresearchgroup.com/p/investing-timeframe

Whenever I see a strong tailwind pushing an asset forward, I pay close attention.

Back in 2003, Apple launched the iTunes Music Store.

Source: Apple Insider

For the first time, music could be downloaded instantly, transferred to an iPod, and enjoyed without stepping foot into a CD store.

Song previews, one-click purchases, instant downloads.

It was a tectonic event!

When I saw, I knew

Most people did not believe Apple would revolutionize the music industry at the time.

This was before the iPhone or iPad were introduced.

The only 2 things people saw were:

iPod and iTunes Music Store.

Investors thought those were just a hobby product and service from Apple.

Most were thinking Apple as a computer company, not a consumer electronics company.

But I knew the way we enjoy music had changed forever.

As a university student, I did not have much cash to invest.

What I did know:

The tailwind was real.

In 2006, I took what little I had saved from skipping eating out and living on PB&J and spaghetti for a week, and I bought some Apple stocks.

Adjusted for multiple stock splits since then, those shares would be priced at roughly $1.41 each.

Over nearly two decades, I trimmed some and added more along the way.

In April 2025, I finally exited half of my position in Apple at around $200 per share.

Source: Yahoo Finance

The lesson is simple.

Tailwinds matter. Time frame matters.

When there’s a strong tailwind, we want to give it time to capture the upside from the opportunity.

Alberta has that kind of tailwind.

That is why I study macro trends.

It is far easier to generate strong returns when demand is being pushed forward by structural forces like population growth.

Even though Alberta real estate has hit a short-term speed bump, the long-term fundamentals remain intact.

For the investors who understand the investing time frame, this current blip in the market is just that, a blip.

I remain very bullish on Alberta for the long term.

Even if I have not written about it much lately.

If you like my work, I invite you to share it with others.

Eric Chang

Cardston, Alberta, Canada

February 10, 2026

Copyright © 2026 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.