Best performing asset in 2025 (so far)

It's not what you think

Yesterday I presented at a Private Investor Zoom call, hosted by my friend Adrian.

As I do with most of my presentations, I usually share the research I’ve done on macro economics.

If you have been following me for a while, you know the importance I place on understanding the “bigger picture”.

How macro economics affect our investment portfolios, especially when it comes to risk management, protecting our hard earned money for retirement and creating a return that is justified on a risk/reward basis.

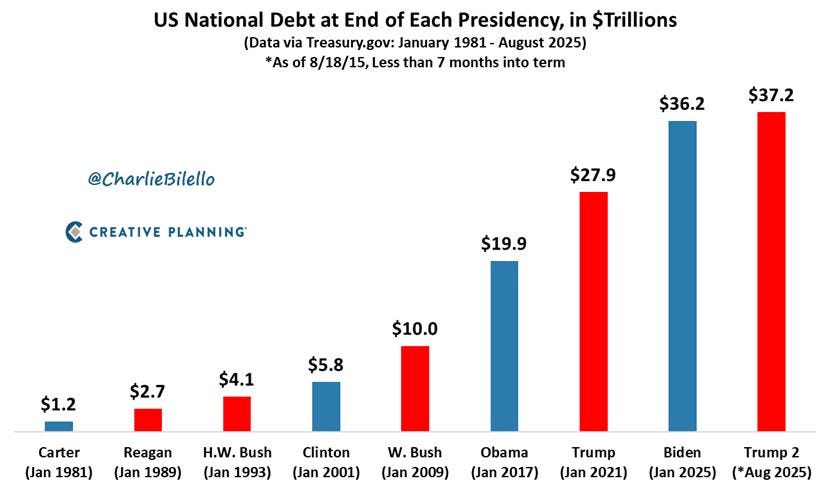

We discussed the “old news” around reckless government spending

Regardless of which Party is in power in the US, each administration is determined to out spend the previous one.

Take a look at this chart.

Credit: Creative Planning, Charlie Bilello

No one wants to be the “bad guy” and do the right thing.

For years, the increase in government debt hasn’t been too much of an issue... Economically speaking.

Everything changed over the past few years.

Just like many households who took on too much debt when the interest rate was low over the past few years, these debt are now up for renewals.

Similar to a mortgage refinancing, these government debts are now refinanced at a much higher interest rate, resulting a significant increase in debt service or debt payments from the income collected from taxpayers.

The right thing would be to pay down the debt

But no “smart” politician is going to do that.

That is political suicide.

The alternative is simply too tempting:

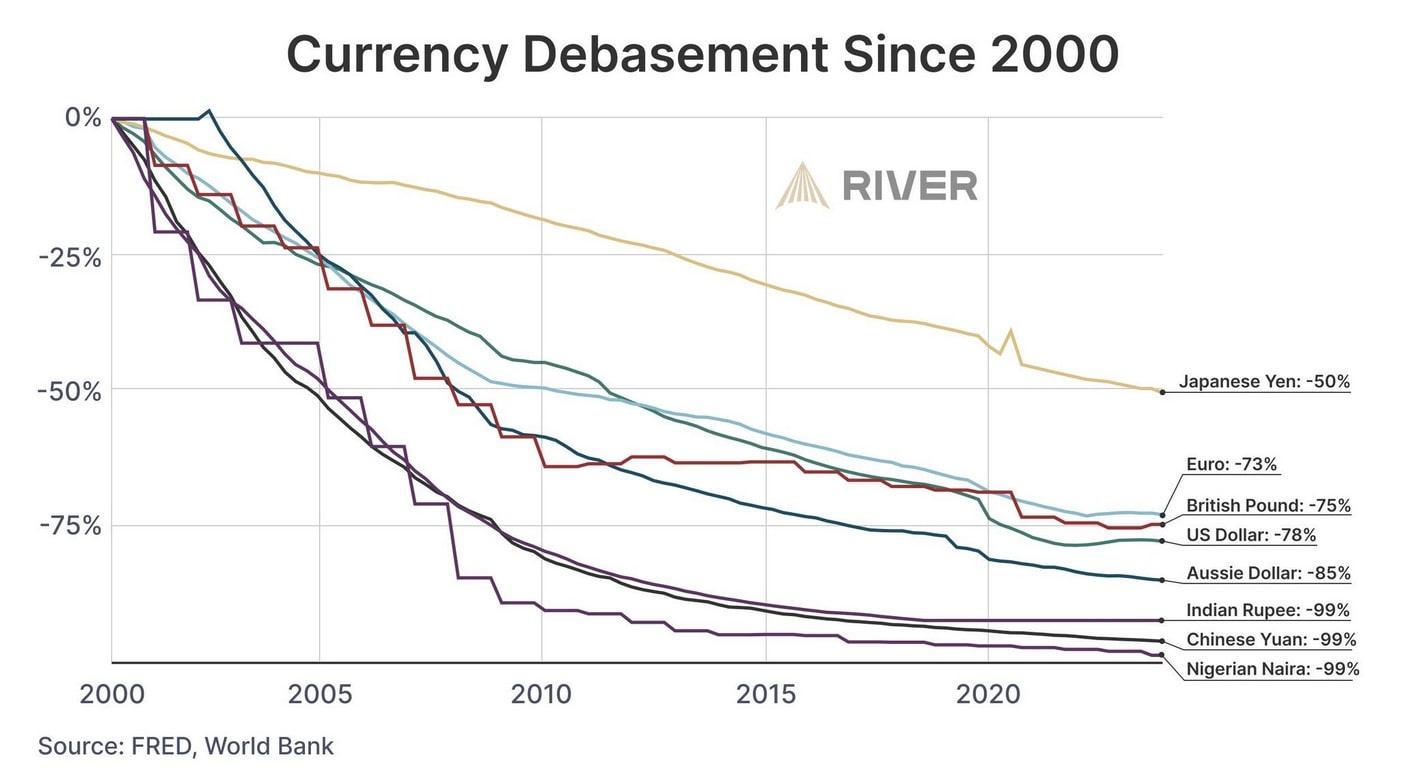

Print more money and kick the can down the road.

Fewer people would get mad at you if you slowly devalue (debase) their money over time.

It’s another form of tax, but with fewer people really noticing it.

The money printer went into overdrive during the pandemic.

Most Americans and Canadians haven’t experienced high inflation in modern history.

The last time high inflation is around, was in the 70s.

Today, those who still remember what happened back then, they are in their 70s.

That means, not many people today have the experience or true understanding of what it feels like during high inflation.

It worked until it didn’t

Now for the first time in modern history, we’re seeing the devastating effect of inflation.

Skyrocketing home prices, expensive flights, even eating out at restaurants would require spending a min. $100 for 2.

We’re seeing price increases in grocery stores, in shopping malls, everywhere.

This is the symptom of a debt spiral.

The massive money printing has money flowing into all sorts of financial assets.

Real estate was a blockbuster during the pandemic.

Bitcoin took off like a rocket this past year.

Stock market seemed like they are having a good year this year.

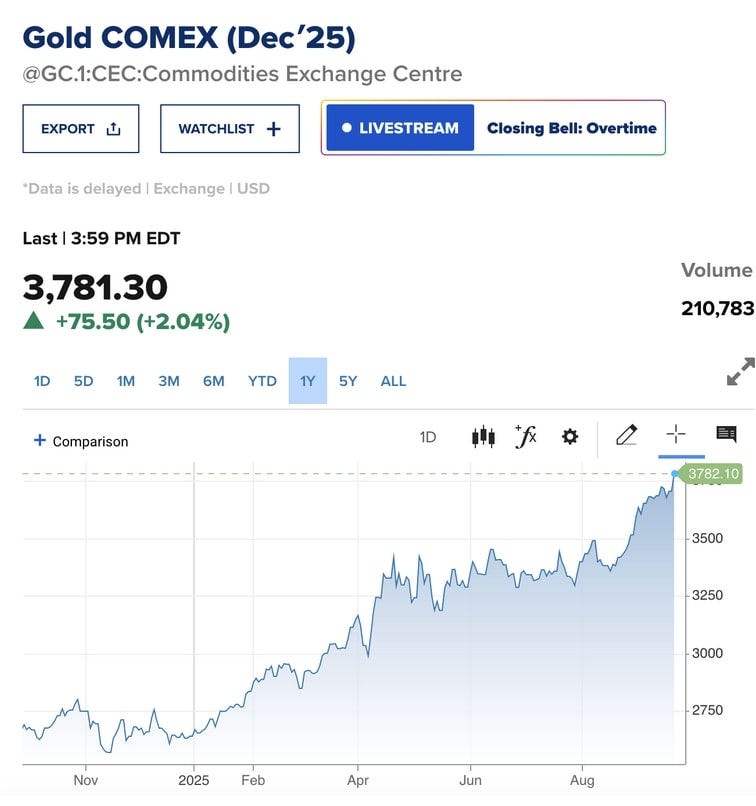

Did you know, the best performing asset so far in 2025 isn’t the stock market, bitcoin or real estate

It’s Gold!

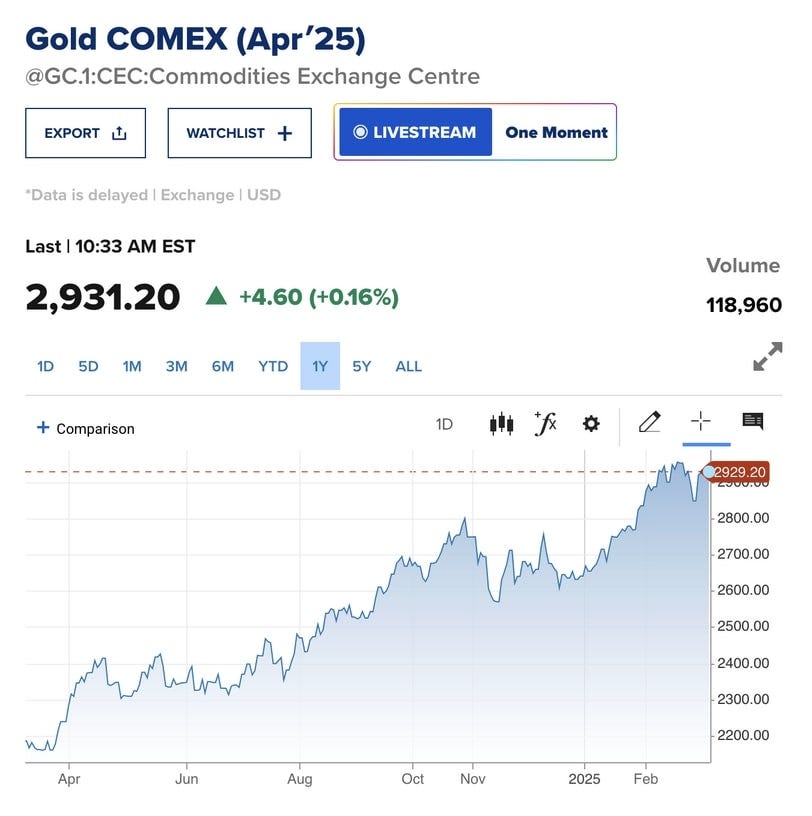

Take a look at these 2 charts and see what Gold has done.

Credit: Google Finance

That’s what we discussed during the Private Investor Zoom call.

Of course, if you’ve attended my previous Private Investor meetings, you already know about gold.

We talked extensively about gold at the beginning of the year.

When the price was less than $3,000 US / oz.

Credit: CNBC

As of Monday, Gold has climbed up to close to $3,800, with $4,000 around the corner.

If you believe government and politicians will finally get our spending control, then keep doing what you’re doing

But if you’re like me and many who have studied history, know that over and over again, humans tend to keep repeating the history.

A once prosperous country / empire later got burdened by high debts:

Roman Empire, Ottoman Empire, French Monarchy, British Empire, etc.

It’s why it’s called human nature.

Because humans simply can’t help themselves.

Being a fiscally responsible politician is as rare as a unicorn.

This is why the smart money - ultra high net worth investors have been accumulating gold.

This is why strategic money - central banks around the world have been buying gold.

This is why I shared these things with a private group of investors started back in November last year and continuing on this year.

If you’re interested to watch the replay of our meeting on Monday, reach out to Adrian by replying to this newsletter and he’ll email you the recording.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

September 23, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.