Change your plans when the wind changes direction

The Captain said we’re skipping the port tomorrow

This is your Captain speaking.

A loud voice suddenly being broadcasted from the speakers on the ceiling in the dining hall on a cruise ship.

Due to the change of weather condition, we will not be stopping at our previously scheduled port, La Spezia (Italy).

Did you hear that?

We’re skipping the port tomorrow.

A fellow cruiser commented at the table.

Are you sure?

The Captain just said we’re skipping the port tomorrow because of weather.

The mood at the table dropped a notch.

Everyone were excited about what we had planned to do in La Spezia.

The excursions booked, the celebrations planned, all got cancelled.

Because of bad weather.

It’s disappointing when plans don’t go as planned

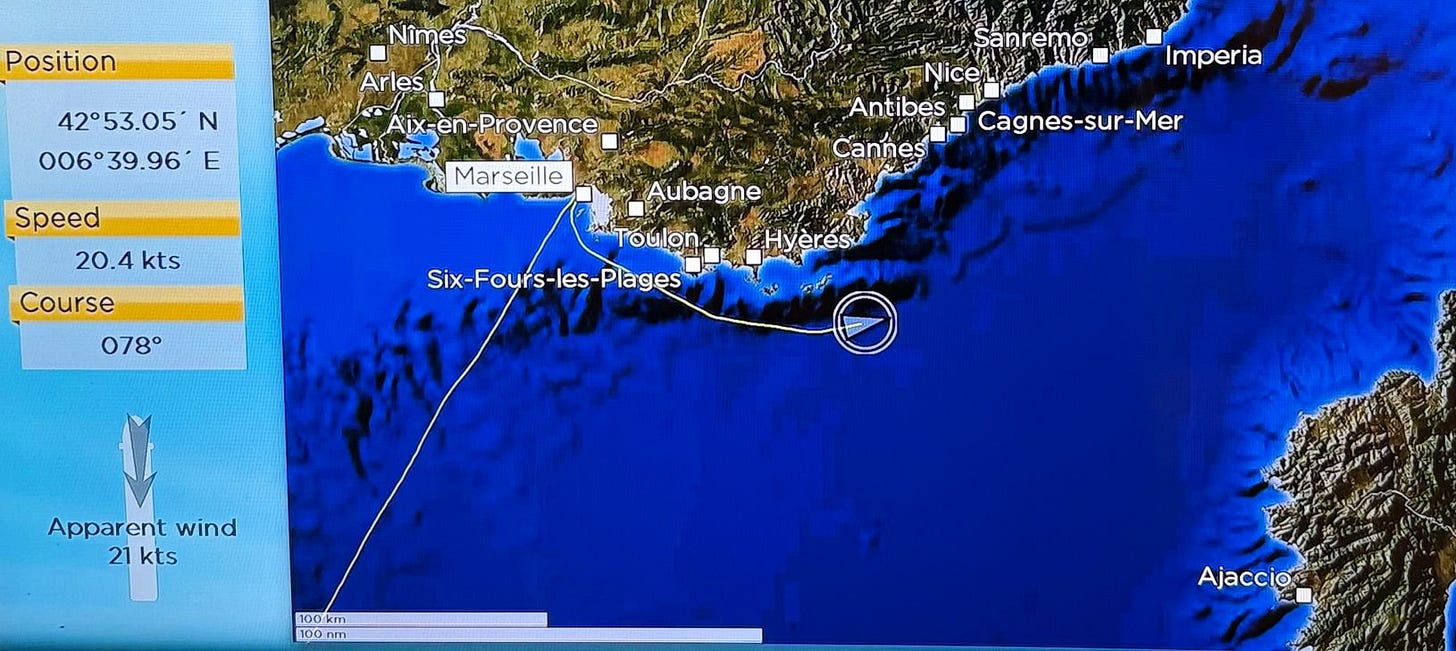

I’m currently on a cruise in the Mediterranean with a group of investment fund managers.

For months, we have looked forward to this trip.

It’s disappointing when the plans have changed due to something out of our control.

I wanted to share my trip experience with you because the same thing applies to the investments we make in our portfolio.

Whether we like it or not, we are humans powered by emotions.

That means, it’s human nature to create attachments to our investments.

The first investment property.

The best performing stock.

The favorite real estate market.

When it comes to investing, emotional attachments to our investments can be tricky.

When you can’t change the direction of the wind, adjust your sails

Well said, H. Jackson Brown Jr.

For many newsletter issues, we have talked about real estate, macro economics.

Last few weeks, we mentioned a different asset class completely - Gold.

It may be new to some of you.

It may be foreign to some of you.

It may even be an asset class you have never considered before.

It’s understandable.

It’s comfortable to go with what we know.

To many, that’s stocks, bonds and real estate, 3 of the most commonly owned asset classes.

At the risk of losing readers (yes, people unsubscribed after I published the previous issue), I’d like to invite you to have an open mind.

Markets can remain irrational longer than you can remain solvent

A great quote from famed economist, John Maynard Keynes.

One thing that took me over decades to learn is to NEVER fight against the market.

The market’s force is ALWAYS the most powerful.

Just like it would be unwise for our cruise to fight the weather condition, it’s best to change the plans.

Over 2 decades of investing in multiple different asset classes, one thing I learn to watch closely is where the wind is blowing.

It wasn’t long ago when real estate prices were hitting all time highs in Ontario and BC, only to see the markets turn their backs in the recent months.

After years of blowing in 1 direction, the wind does change course!

The best investors aren’t married to 1 “thing”

Even the famous Warren Buffett has known to change his tune when the wind changed direction in the past:

When Buffett began buying Apple shares in late 2016, many market observers were surprised—he had famously avoided technology stocks for decades, claiming they were outside his “circle of competence.” However, Buffett saw something in Apple beyond its classification as a tech company—a consumer brand with unprecedented loyalty and pricing power.

Source: https://www.investopedia.com/the-investment-that-made-buffett-billions-11817750

Before you write off Gold as an asset class that doesn’t make sense to you, I invite you to research about today’s macroeconomics.

Like any asset, real estate, bonds and stocks are great assets to own, when they are priced attractively.

The investment case of owning an asset goes away, when one overpays for them.

Today, macroeconomics is showing us the wind is blowing in a different direction.

In fact, anyone who has been following Gold would tell you, the wind has been blowing in a different direction for the past few years already.

It’s just that not everyone is paying attention.

I hope by writing about it here, you may begin to pay attention.

If you like my work, I invite you to share it with others.

Eric Chang

Marseille, France

September 30, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.