Don't Write Off Canada Yet

Happy Canada Day

Welcome to EC Research Group Newsletter

Previously the Why Alberta Now Newsletter

We’re moving to a new name to better reflect on my whys of writing these newsletters:

Sharing unique market insights you won't hear in mainstream media.

No jargon. Critical thinking. Connecting the dots in plain English. Know what others do not.

Empowering busy investors in less than 10 minutes.

This newsletter was originally started as I wrote about the Alberta Real Estate market.

Soon, I expanded to covering more about the macro economics.

Our subscribers base are gradually growing outside of Alberta and Canada as well.

Hello to many of you I haven't had the opportunity to meet.

For today's newsletter, given it landed on Canada Day, I'm going to go back to Canada, eh!

Many Canadian investors or even Canadians in general have been frustrated with the direction of the country.

The data clearly shows it:

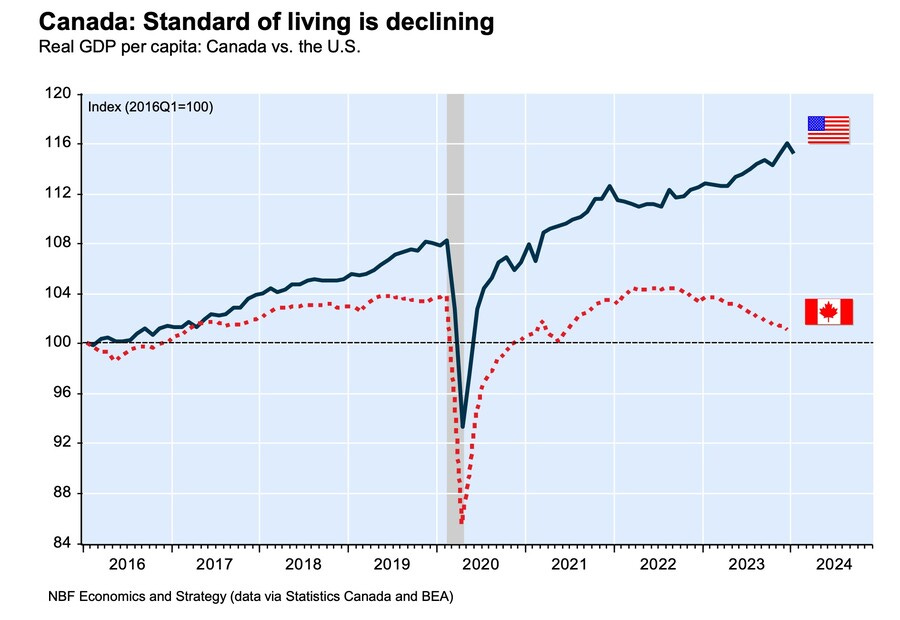

Canada's GDP per capita barely moved in the last 10 years - Many economists refer this as "Canada's lost decade"

Source: https://betterdwelling.com/canadian-standard-of-living-plummets-lower-approaching-lost-decade/

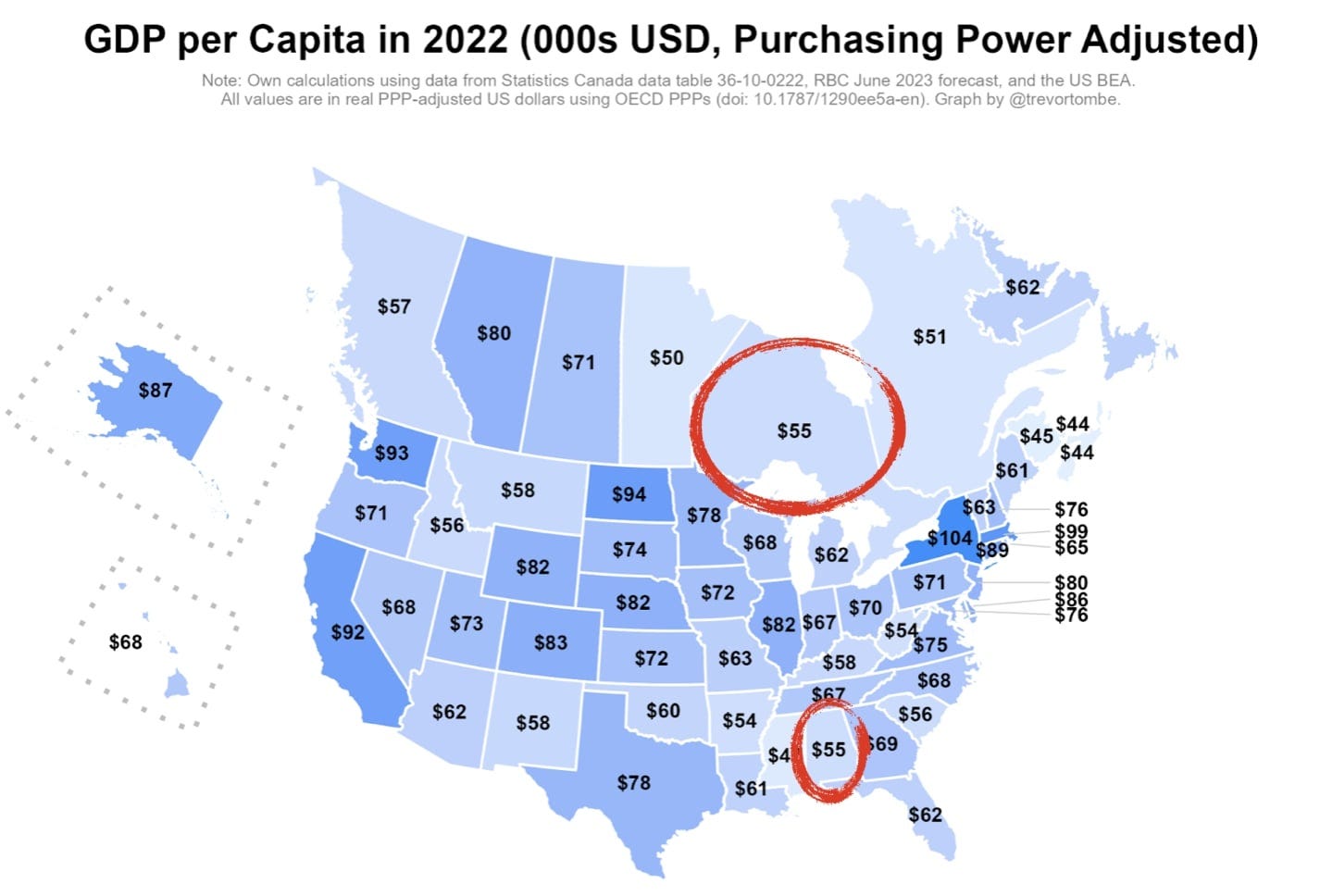

Canada’s largest economy, Ontario has about the same economic output as Alabama

Source: https://thehub.ca/2023/06/15/trevor-tombe-most-provincial-economies-struggle-to-match-the-u-s/

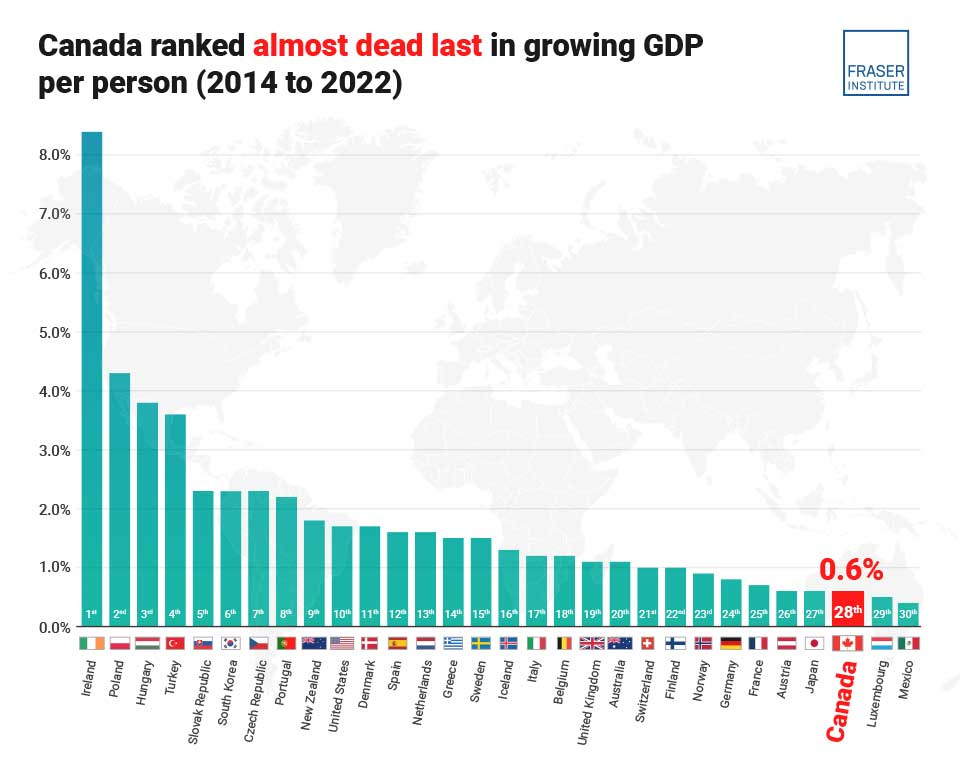

Out of the major economies, Canada ranked almost last in GDP growth per person

It's hard to get excited about the Canadian economy.

There's one thing that Canada has done a decent job that are not getting the spotlight - CPP or Canada Pension Plan

We regularly hear about the Social Security in the US going "insolvent"

Yet, we don't hear about the same crisis with CPP.

This is one area Canadians could be proud of, especially on Canada Day.

Why does it matter?

This is one of those things:

It doesn't matter until it does.

As investors, this is part of a long term investment fesability assessment based on future governmental policies.

That means there are few options on the table:

Increase taxes to fund the short fall

Decrease benefits to Social Security recipients

Print more money to inflate the obligations away

The future burden on US taxpayers (personal & corporations) is going to get heavier and heavier, this opens up further risks for future investment in the US with potential higher taxes and slower economic growth.

Celebrating Canada Pension Plan (CPP)

From The Hub:

The CPP is now a financial behemoth that ranks among the world's largest pension funds.

Sitting on $576 billion today—$200 billion more than anticipated just a few years ago—the CPP Fund is projected to exceed $1 trillion by 2031 and reach as high as $1.5 trillion five years later. It’s stuffed with more than enough money to pay out benefits for the next 75 years.

On the surface, it may seem that both CPP & Social Security are retirement benefits, same thing with different names.

How is it possible that Social Security is heading to insolvency in 7 years when CPP is solvent for the next 75 years?

CPP vs. U.S. Social Security

There are fundamental differences between the two.

The 3 main differences are: Funding model, investment strategy, and governance.

Canada Pension Plan (CPP)

Funding Model: Partially Funded / Pre-Funded

The CPP is partially pre-funded: contributions are invested in a professionally managed fund to help pay future benefits.

Investment Strategy: Diversified Investments

Managed by the Canada Pension Plan Investment Board (CPPIB). The CPPIB invests globally and across asset classes (equities, real estate, infrastructure, private equity).

Governance: Prioritize on Sustainability

Actuarial reviews are mandated every 3 years. Any shortfalls will trigger automatic contribution increases or benefit adjustments.

U.S. Social Security

Funding Model: Pay-As-You-Go

Today's workers' payroll taxes are paying today’s retirees. The number of current recipients has grown relative to the number of workers paying taxes, an imbalance that continue to get bigger as baby boomers continue to age.

Investment Strategy: Government Bonds Only

The Social Security Trust Fund is only invested in U.S. Treasuries, typically generates low returns with no diversification.

Governance: Depends on Congress

There's no automatic adjustments to benefits or taxes until Congress passes laws. It's a political suicide to cut benefits to the demographic that shows up to vote.

Be proud of CPP

CPP is the backbone for many Canadians and the Canadian economy.

A strong pension fund creates a strong base for the middle class.

That's a foundation Canada can build on.

If you're a Canadian: Happy Canada Day

If you're not a Canadian, we'd love for you to come visit.

It's beautiful up here.

This is one of my favorite biking trails - between Banff National Park and Town of Canmore.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

July 1, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.