Goodbye DOGE, hello DUMP

A department you have never heard of

Every once in a while, a politician announces a bold plan that captures headlines and ignites hope.

Earlier this year, that plan was DOGE.

DOGE was supposed to cut one trillion dollars of US government spending.

A trillion.

Instead, the opposite happened.

According to several reports, the US government added almost two trillion dollars to the national debt this year.

It was the fastest accumulation of one trillion dollars ever recorded outside of the once in a century pandemic.

And with eight months still left on its mandate, DOGE has been quietly shut down.

Reuters and Newsweek both confirmed the program effectively no longer exists, even though it was originally promoted as a major fiscal overhaul.

DOGE was introduced to “fix” a spending problem.

Turns out, DOGE didn’t solve anything.

Because the real problem is much bigger.

The problem is that the US government is addicted to debt.

The debt clock is moving faster than ever

Last month, PBS reported that the US crossed 38 trillion dollars in total debt. This happened during the fastest one trillion debt increase in modern history outside the pandemic period.

Let that sink in.

When debt grows faster than the economy for years on end, the math becomes unavoidable.

DOGE shutting down is not the story.

The debt machine powering Washington is.

It does not matter which political party is in charge.

Both sides have discovered the same magic button.

Spend today.

Let the next generation worry about tomorrow.

Meet DUMP - A department you have never heard of

Forget DOGE, DOGE is gone.

The real powerhouse is something far more enduring.

I call it DUMP:

The Department of Unlimited Money Printing.

Of course, it is not an official department.

But it might as well be.

Every time there is a crisis, DUMP steps in.

Every time there is an election, DUMP gets busy.

Every time politicians promise something they cannot afford, DUMP quietly delivers.

While DOGE collapsed, DUMP continues its work behind the scenes.

Efficient.

Reliable.

Always available.

And every year, the US dollar pays the price.

A currency that only moves in one direction

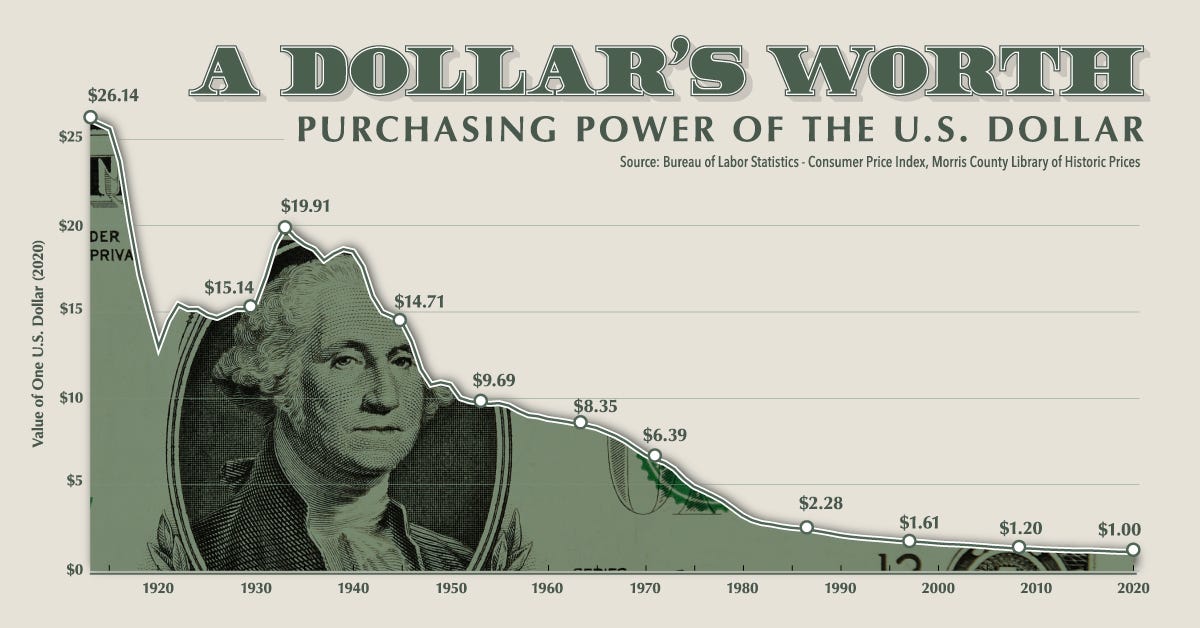

Take any long term chart of the US dollar.

Image Credit: https://www.visualcapitalist.com/purchasing-power-of-the-u-s-dollar-over-time/

The line goes only one way.

Down.

Since the creation of the Federal Reserve in 1913, the purchasing power of the US dollar has fallen by more than 95 percent.

The speed of that decline is now accelerating.

This is not a surprise.

When a government becomes dependent on expanding debt, currency debasement becomes a feature, not a bug.

This is why inflation feels higher than what the government reports.

This is why asset prices have soared since 2020.

This is why savings accounts and bonds that look safe on paper quietly lose value in the real world.

We wrote about this same asset inflation risk before.

Whenever money printing increases, all that new money has to go somewhere:

Real estate.

Stocks.

Gold.

Everything denominated in dollars gets repriced higher.

It is not growth.

It is dilution.

What investors should pay attention to

Speaking to many investors, it’s apparent that investors are concerned or scared.

Many are holding still, waiting for “opportunities”.

While DUMP is getting ready to dump more money in the coming months.

Meaning, assets such as Gold could start to climb again, even after reaching all time high.

If it helps, think backwards:

You are not investing in assets.

You are investing against a system that is built on debt expansion.

The market already knew the truth before the headlines caught up.

This is why I study macroeconomics closely.

This is why I focus on real assets such as Real Estate, and Gold.

This is why owning something real matters so much more than holding a currency the government can create at will.

The winds have been blowing in this direction for years.

The shutdown of DOGE is simply another reminder that politicians cannot and will not reverse course.

But DUMP, the Department of Unlimited Money Printing will never be shut down.

As certain as I am that sun will come out tomorrow, the decline in purchasing power of fiat paper money will continue to accelerate.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

November 25, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.