How time frame impacts our portfolio

From 10% to 33% annual ROI

Last week we explored a model of diversification based on time frames:

Long term investments

Mid term investments

Short term investments

If you missed it, you can catch up here:

https://ecresearchgroup.substack.com/p/investing-timeframe

We also discussed the several serial entrepreneurs' investment portfolio constructed using the time frame model.

As someone who is also a serial entrepreneur, who has done businesses in several different industries, I found myself relying on the "time frame" portfolio model more and more.

I "fell into" this model by accident

Many years ago, I was running a marketing agency.

The industry is very exciting and challenging.

Exciting because it keeps changing.

Challenging because it keeps changing.

If you know me, you know how much I like learning new things.

Ferocious learner is perhaps a good way to explain myself.

The online marketing industry, is known to replace 50% of it's knowledge every year.

It kept me on my toes.

What made the knowledge replacement so high?

Think about it.

Every year, Facebook, Google, YouTube would come out with new algorithms, new design, new policies that could upend everything you have done for your marketing campaign and strategy.

Not to mention, our clients’ competitors were constantly watching what they (we) were doing.

Once we came up with something great, give it a few months, guaranteed it will be copied by others.

It was exciting and challenging!

Great place for people in their 20's to thrive on.

Didn't take long for me to realize there’s no job security in marketing

It's a young people's game.

There's no luxury to take any breaks.

Out of necessity, I had to look in the opposite direction for my retirement.

I wanted something that's the opposite of fast.

I wanted something that will be around 100 years from now.

I wanted something that "time in the market" is the strategy, compared to constant innovation to stay competitive.

That's how I found real estate.

You see, real estate is the opposite of fast.

The longer one plays the game, the better they will do.

Just like the board game Monopoly.

If one has assets and can stay in the game long enough, you will win.

Simple. Slow. No brainer.

That's just how I like it with my investments especially when I was working full time at my marketing agency.

I didn't realize it then, that's also how I stumbled on this "time frame" portfolio model.

Case Study: Eric's time frame portfolio

Let's go back 10 years in time.

Short term investment:

Most of my time was invested in the marketing agency based in Lethbridge, Alberta.

The strategy was simple.

The agency had 2 objectives:

Create an income for myself and my team with minimum profit left over

Develop marketing IPs using our clients marketing budget

I wasn't concerned about making a lot of profit at the agency.

It was meant to make enough to pay for everything.

The IPs or marketing strategies was what I was going for.

A great marketing strategy takes a ton of resources - time, money to develop.

Our clients were happy to pay us a retainer for us to do marketing for them.

It could take us 3-4 months to develop a new marketing campaign.

Some campaigns hit it out of the park.

Some were duds.

Once we found out what strategies worked best, it's ours to keep.

That led me to Mid term investments

From time to time, we were able to replicate the same marketing strategies in another market segment not in direct conflict with our clients.

One of my best Mid term investments was exactly that.

We duplicated the same strategy we developed for a client and built it out in a different market.

That 1 business ended up resulting in millions of dollars of products sold online providing me with a stream of residual income for around 10 years.

Not too shabby for a business that I got for "free".

Long term investments: Real Estate

Finally, real estate portfolio.

The intention from day 1 was to build a retirement portfolio in real estate.

This shifted the focus to look at the investment time frame to 25+ years.

The short term fluctuations in the market was less of a concern.

The optimization was on the sustainability of the asset for long term holding as opposed to short term profits.

Interestingly, that was what happened.

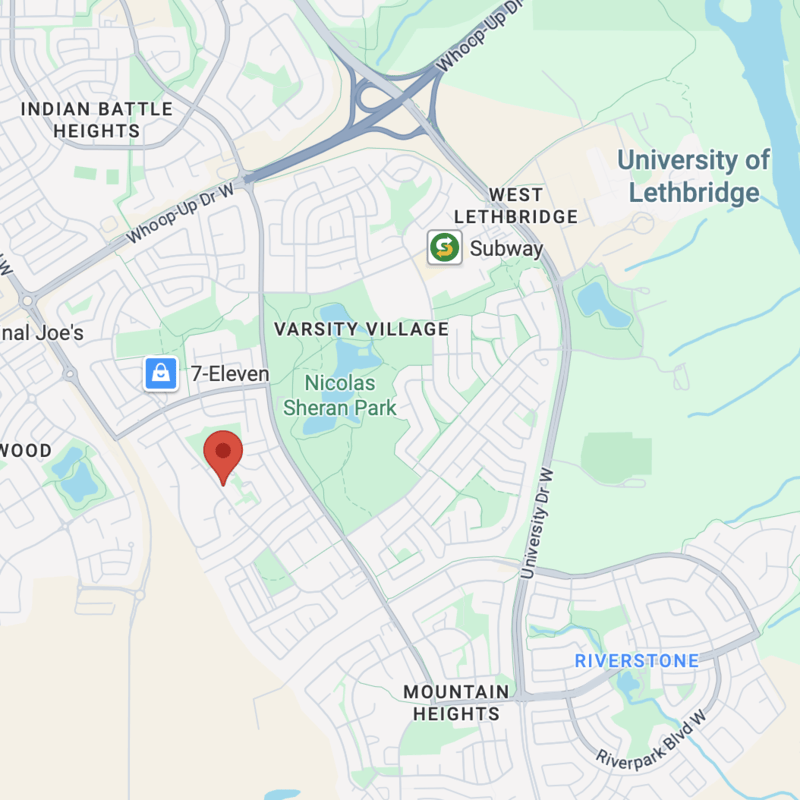

My first real estate investment - Credit: Google Maps

When I first got into real estate, I didn't understand the market cycle as I do today.

I bought it at the very top.

Soon, the market flat lined for almost 10 years!

It didn't "crash", but it didn't go up much either.

Because the focus was on long term sustainability, the asset was cash flow from day 1.

It wasn't much.

$50-100 / month back then.

But we stuck to the rule of only buying cash flowing assets.

For 10 years, it didn't look like an investment to "brag" about.

The mortgage was paid down - around 75k over 10 years.

That was about it.

Everything changed over the past 5 years

The property has appreciated by around 100k, doubling the mortgage pay down.

Adding it altogether:

100k appreciation + 100k mortgage pay down + 20k cash flow = 220k in gains

For a property that was purchased for 220k with a down payment of 44k:

The return as of today is 500% (220k/44k) over 15 years, resulting in averaging 33% / year (500% / 15) in ROI.

A humble little house that I still own today, ended up producing a return that beat the stock market by a mile.

This is why time frame matters.

The very same property that was only producing around 10% return / year during the first 5 years, yet it turned into a blockbuster investment, when the asset was given the appropriate time frame to perform.

Did I know these things when I first started investing?

No, I didn't.

But I do now.

That's why I'm sharing this with you.

Because, too often, I hear investors comparing investments. Oftentimes, they are really not apples to apples, more like apples to oranges.

Different asset and market cycle impacts how it's positioned in a portfolio from a time frame view.

If you find this useful, reply and let me know.

There's a lot more I can dive deeper into this model, if this is of interest to you.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

September 2, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.