Investing timeframe

Invest like serial entrepreneurs

If I ask you:

What's in your investment portfolio?

What would you say?

Let me take a guess:

If you are like most investors, you may say -

I invest in real estate, stocks, bonds, private businesses, maybe even crypto or precious metals.

That's a typical response.

Now, if I ask you how you build your investment portfolio, what would you say?

The popular response is:

Diversification

If we take a step deeper, and ask:

How do you diversify?

The most common responses I've heard -

If they invest in stocks: I diversify with blue chip companies that have a long track record of paying dividends with some high tech growth companies and a small exposure in mid-cap stocks.

In addition, some may add: Majority of my stock portfolio is based in US / Canada and a smaller portion invested in Europe and emerging markets.

If they invest in real estate: I diversify my real estate portfolio with single family, multi-family.

If one has generational real estate wealth, one may say: We own some farm land or raw land, office and retail complexes.

If one invests in bonds: I diversify with government bonds, municipality bonds, and corporate bonds. Most in investment grade rated A to AAA.

Or this: I do the bond ladder strategy, with staggered maturity dates to create a steady income stream and reduce reinvestment risk and interest rate risk.

A different way to diversify

While those are all good responses, I find that serial entrepreneurs often look at their investments differently.

They look at investments on a time table:

Long term investments

Mid term investments

Short term investments

What made them invest this way?

Because they understand how business and market cycle works!

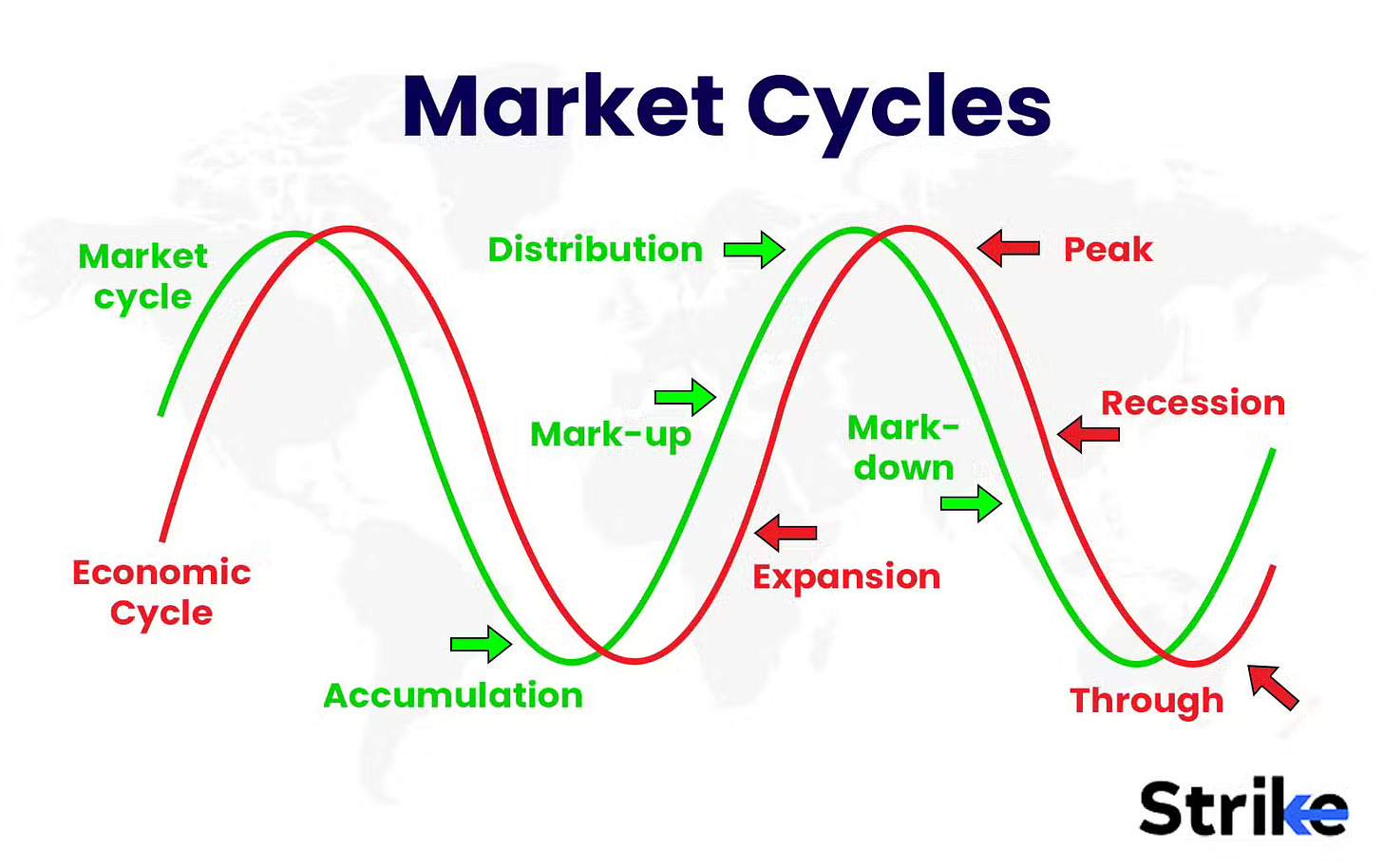

Business cycle or also called economic cycle goes through expansion and contraction, reaching peaks and hitting troughs.

It's what's commonly known as economic expansion and recession.

Source: https://www.strike.money/stock-market/market-cycles

Market cycle describes the market conditions of the asset class.

For example, stock market go through bull and bear markets, boom and crash.

Real estate also goes through boom and bust cycles.

For many Canadian real estate investors, most are very aware the fact the market in Ontario and Vancouver are going through the bust cycle after years of incredible boom.

For the US real estate investors, many are familiar with the boom and bust of multi family assets between 2020 to today.

Serial entrepreneurs' investment edge

It makes a lot of sense if you think about it.

These are people who are skilled at starting and running businesses.

That means, they understand the business cycle extremely well.

If you ever want to know the experience of an entrepreneur, ask them what's their plan to navigate through a business cycle.

If a business doesn't have strategies to operate in a recession, it usually shows the entrepreneur hasn't been around long enough.

Now, if you combine the skill of navigating business cycle with market cycle, you'll get an entrepreneur who likely have started and sold multiple businesses, some called "serial entrepreneur".

These people are a breed of themselves.

Combining the ability to navigate business cycle with market cycle, it makes them ultra successful in growing businesses AND maximizing wealth.

Growing a business uses good skills in navigating the business cycle.

Maximizing wealth uses a good sense of grasping the market cycle.

Let's look at how some serial entrepreneurs build their portfolio with different investment time frames

1. Mark Cuban

Long-term: Holds sports/media/core wealth in diversified assets.

Mid-term: Startup investing via Shark Tank (5–10 years to maturity or exit).

Short-term: Opportunistic plays in crypto, pharma, and public stocks (he flips fast when thesis breaks).

2. Richard Branson (Virgin Group)

Long-term: Virgin Atlantic, Virgin Galactic (built on decades-long bets in travel/space).

Mid-term: Telecom (Virgin Mobile), healthcare, renewables (often structured as 5–10 year ventures).

Short-term: Tactical brand partnerships & licensing deals to monetize “Virgin” brand in real time.

3. Peter Thiel (PayPal, Founders Fund, Palantir)

Long-term: Palantir, biotech (longevity, anti-aging, deep tech).

Mid-term: Venture capital bets in startups he expects to flip or scale in 5–7 years.

Short-term: Tactical moves in crypto, and hedge-style investments.

4. Marc Andreessen (Andreessen Horowitz)

Long-term: Core belief in tech platforms that compound over decades (Facebook, Coinbase, OpenAI).

Mid-term: Typical VC fund cycles (7–10 years).

Short-term: Personal tactical allocations in hedge/crypto markets (he’s been open about quick exits on non-core plays).

5. Reid Hoffman (LinkedIn, Greylock)

Long-term: LinkedIn equity (held long-term until Microsoft acquisition).

Mid-term: VC bets through Greylock (5–10 year horizons).

Short-term: Advisory/tactical angel deals, some exited quickly when conditions change.

Invest like serial entrepreneurs

You may noticed that a lot of their investments are based on their own business.

That being said, the principle stands.

You too can invest following their model.

No need to be a billion dollar serial entrepreneurs.

For starter, look at your portfolio through the lens of time frame:

Long term investments

Mid term investments

Short term investments

What are your investments that are in the long term, mid term or short term buckets?

In future newsletters, we'll take a deeper look at what each time horizon means for you and your portfolio.

Until then, I'd love to hear any thoughts that come to your mind from looking at the serial entrepreneurs' portfolio.

If you like my work, I invite you to share it with others.

Eric Chang

Calgary, Alberta, Canada

August 26, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.