Investing with less reliable data

The US economy is not as strong as previously thought

Last week, Erika McEntarfer was fired.

If you don’t know who she is, she was the Bureau of Labor Statistics Commissioner.

She was responsible for reporting the US employment reports.

From Reuters:

U.S. employment growth was weaker than expected in July while the nonfarm payrolls count for the prior two months was revised down by a massive 258,000 jobs, suggesting a sharp deterioration in labor market conditions

258,000 jobs downward revision, that’s a massive discrepancy!

The reason for her firing was justified as the report was “rigged” to make the administration “look less stellar”

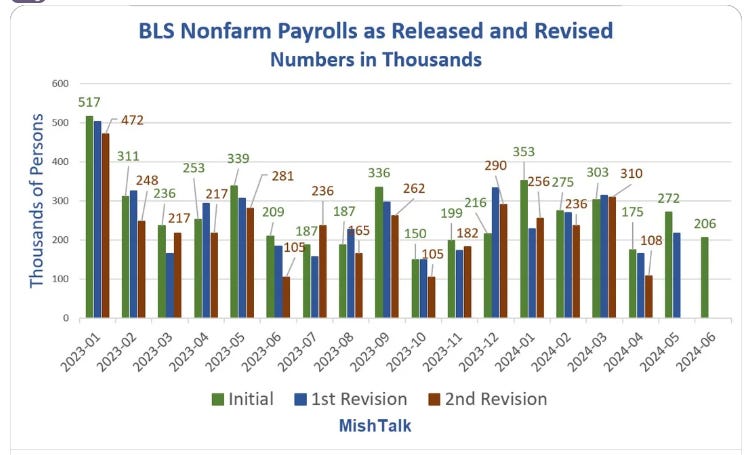

It’s common for the BLS to revise their numbers.

For example, in 2023, the numbers were revised down in 10 out of 12 months!

If the adminstration simply doesn’t “like” what they see from being reported, what does it mean for the future reports coming from the BLS or any department?

This also poses the question:

Would the next hire publish employment numbers that “looks good” for the administration, even if it’s actually bad?

For most of our modern memories, investors and business owners in the Western societies have come to rely on the government data to be a part of their decision making process for risk analysis, due diligence, and projection modelling.

For data to be useful, the accuracy and integrity of the data is critical

It makes sense.

For a complex model that takes in mountains of data, the more accurate the data and the better the modelling (or algorithm), the better it can be at forecasting risks and identifying opportunities.

We’ve grown accustomed to a world that’s powered by data.

Loads and loads of them.

These economic models and risk analysis only works when the data is accurate and reliable.

What happens when data is no longer accurate or reliable?

These models will stop working.

It seems like we are now entering a new era of investing:

Example: CPI data quality is getting worse

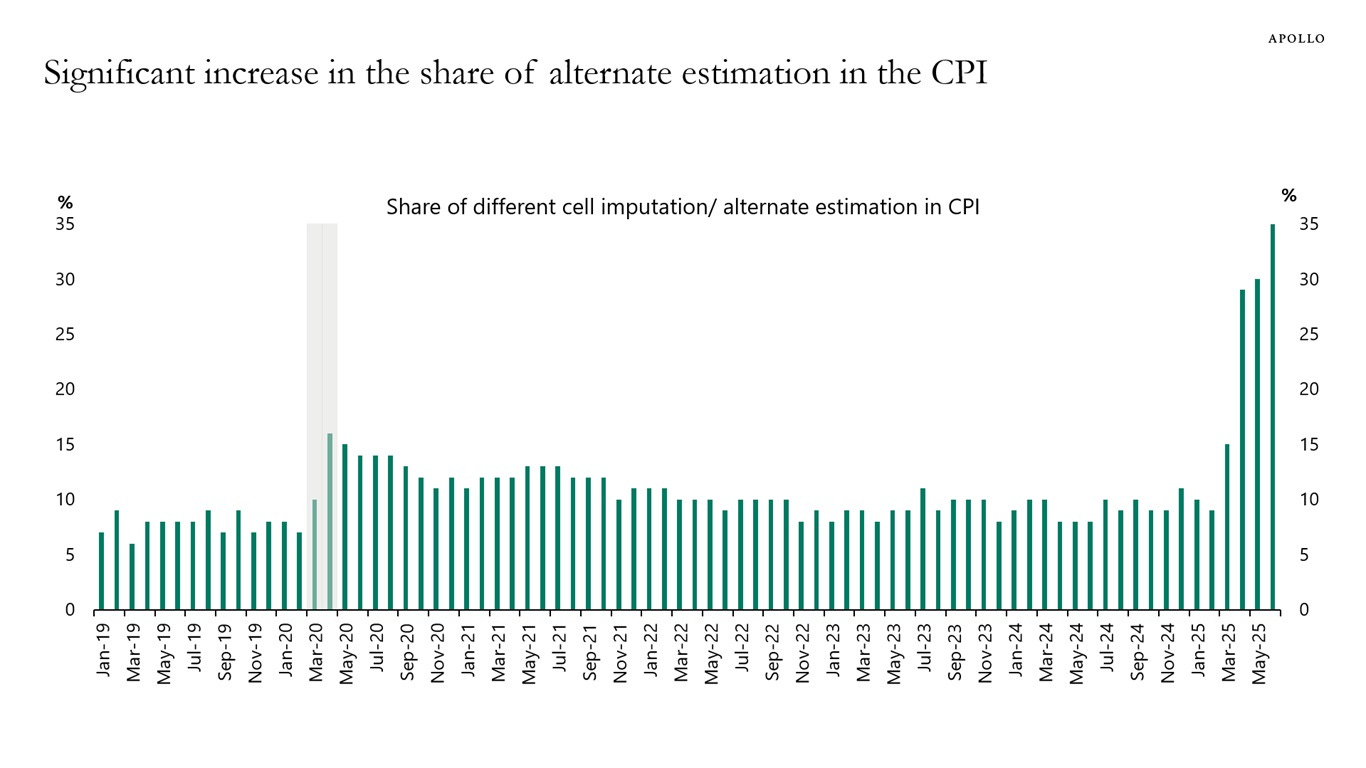

Take a look at this chart.

CPI - Consumer Price Index, is calculated from a basket of data points.

Since the beginning of the year, Apollo, a global investment management firm that manages over 500 billion dollars, has noticed the quality of the CPI data started to decay.

From Apollo:

To calculate CPI inflation, BLS teams collect approximately 90,000 price quotes every month covering 200 different item categories, and there are several hundred field collectors active across 75 urban areas.

https://www.apolloacademy.com/the-quality-of-the-cpi-data-continues-to-deteriorate/

Many of the data points they previously collect from are now “not available”.

When that happens, the BLS team makes an estimation, which is a fancy word for “guessing”.

The percentage of data points are “estimated” keeps climbing, from a previous low at around 10% to now close to 35%!

Think about this, how reliable do you think the CPI data is when a third of the data they normally collect from are no longer accurate?

Investing with less reliable data

Consider this:

What is an investor to do if the unemployment number published looks “good” (suggesting low unemployment) where in reality, the actual unemployment is much worse than what the number suggests?

What if the official numbers suggest the economy is not in a recession, when in reality it is?

These were things Western investors didn’t have to consider much in the past.

The data has been in most part, reliable compared with the numbers put out by the developing countries.

Now, we’re losing the gold standard of data integrity.

Invest differently

This doesn’t mean investors will stop investing.

It means that the smart investors will be the ones who figured out how to invest in a world with “less reliable data” combining with alternative data sources.

One thing for sure is that the data we took for granted for the past few decades are coming to an end.

When the wind change direction, we need to adjust our sails.

As someone who spends a good deal of time researching economic data and looking for macro economic trends, you can rest assure that I’m looking beyond the official government data.

In fact, I have been doing that for a while now.

As subscribers of this free newsletter, you will read about some of these alternative data points in the coming newsletter issues.

For fund managers or real estate investor / managing partners who are interested in working with me as my private client to navigate in this new environment, you can reach out to me by replying to this newsletter.

If you like my work, I invite you to share it with others.

Eric Chang

Port Alberni, British Columbia, Canada

August 5, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.