Money loves momentum

Read this if you're worried about stock market bubble

Last week, we discussed about how Money loves Speed:

https://www.ecresearchgroup.com/p/money-loves-speed

Today, we’re going to explore how a market bubble forms and then pops afterwards.

When asking people about market bubbles, I usually hear about the following:

2001 Dot com bubble

2007 US housing crash

2008 Global Financial Crisis

2014 Calgary real estate crash

2020 COVID market panic

2022 Crypto currency crash

Those were painful experiences investors have experienced in the past 25 years.

Like what happened in the past, bubbles will continue to happen and pop again in the future.

Why do market bubbles happen over and over again?

Short answer:

It’s human nature.

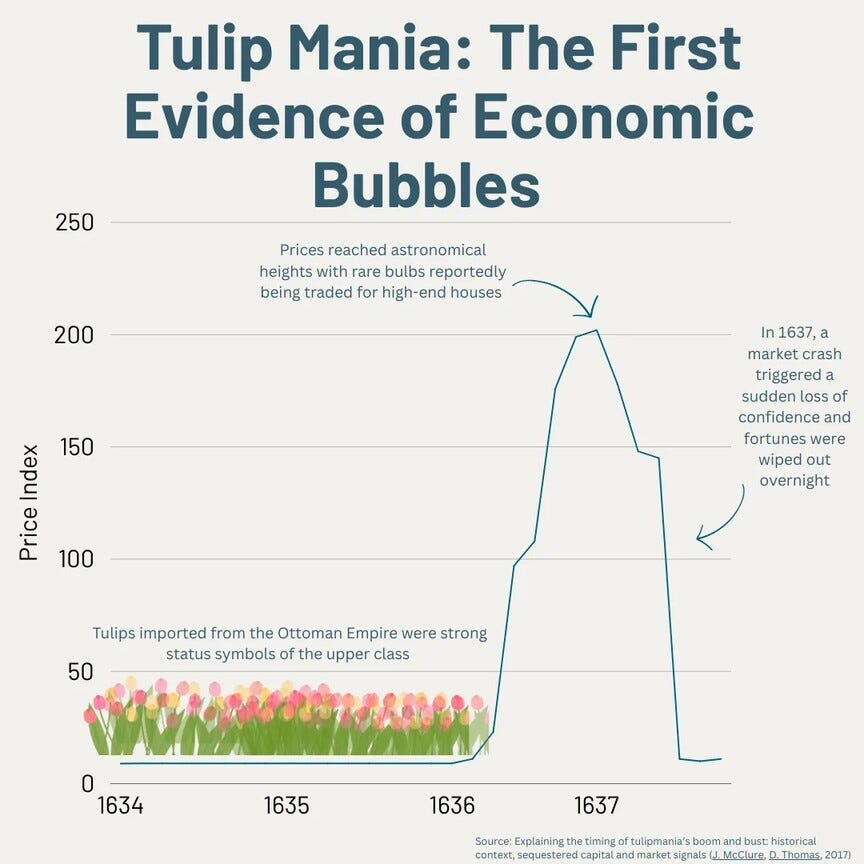

The best case study of a market bubble is the Tulip Mania.

It’s a classic that every investor should study.

It shows how humans can rush into anything and create a frenzy:

Tulip Mania was one of the most famous financial bubbles in history — and an early example of speculative frenzy.

The Dutch tulip bulb market bubble occurred in Holland during the 1630s, when speculation drove tulip value to as much as six times the average person’s annual salary at the market’s peak.

The story now serves as a cautionary tale for the pitfalls of excessive greed and speculation in investing.

The best of tulips cost upward of $1 million in today’s money, with many bulbs trading in the $50,000 to $150,000 range.

It was at this time that professional traders got in on the action, and everyone appeared to be making money simply by possessing some of these rare bulbs. It seemed at the time that the price could only go up, that the passion for tulips would last forever.

People had purchased bulbs on credit, hoping to repay their loans when they sold their bulbs for a profit. But holders were forced to sell their bulbs at any price and to declare bankruptcy in the process when prices began to drop.

Source: https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

A bubble forms when “everyone appeared to be making money”

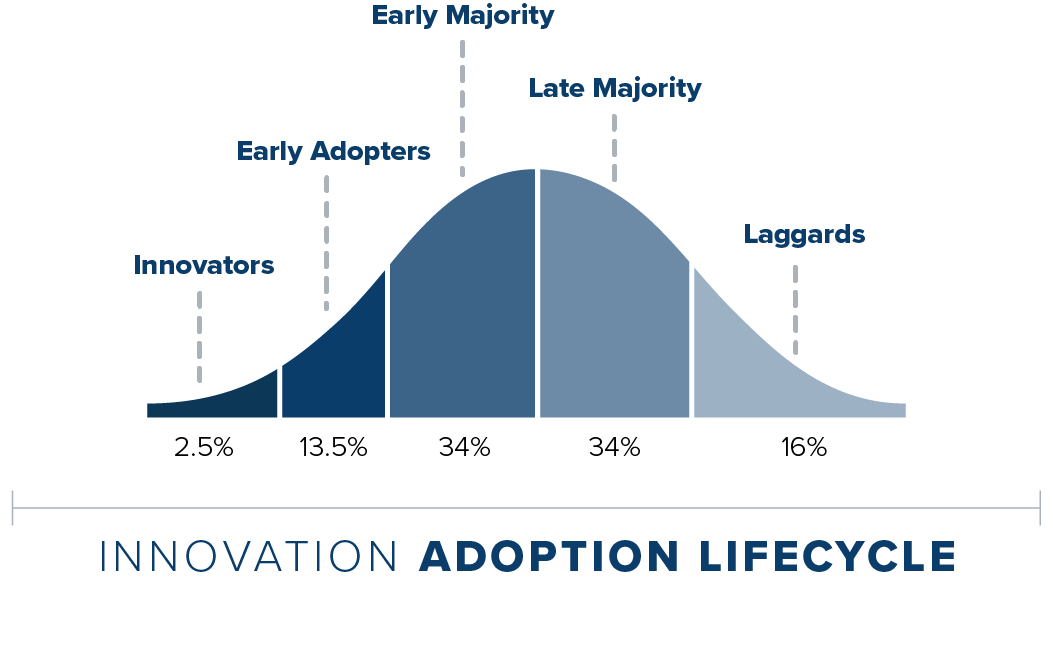

You may have heard of the innovation diffusion curve before on how new technology gets adopted by the masses.

It’s similar when it comes to investing.

A bubble forms as more and more people “adopt” or buy/own the asset.

The early adopters are usually the “smart money”.

They are professional investors who study the market for a living.

They have connections tipping them on best ideas to invest in before most people have heard of them.

For example, in last week’s issue, I shared with you how my buddy and I was tipped off on flipping trucks as an income opportunity before others found out about it.

The early majority are usually people who follows the “smart money”.

For example, Warren Buffett makes his investment moves.

After he invests in a company, he is required to file a public report (Form 13F) with the SEC (Securities and Exchange Commission in the US).

Many investment managers will follow Warren Buffett’s move and invest few months after the report is made public.

Late majority comes in after seeing those smart money investments going up.

They started to chase after those assets.

Pushing up the value of the assets higher.

The smart money is enjoying the gains as more and more investors rushing in.

Finally, the laggards join the party.

These are investors who are late to the party.

But the real fun of the party was already over.

The “laggards” finally feel comfortable investing in the asset because they see all the successes other investors are having.

These are the pent up demand, the FOMO investors who simply can’t sit out any longer.

Except, this is exactly the time when the smart money are exiting and selling their investments.

Leaving the “laggards” left holding the bag, when those skyrocket tulip prices fell back to the ground.

We’re currently in a historic bubble

I believe we’re currently in an AI bubble that will go down in history even bigger than the dot com bubble after it pops.

When will that happen?

It’s anyone’s guess.

I do believe we’re closer to the end than at the beginning.

There will be tremendous opportunity ahead of us after the bubble burst.

If you recall, at the end of the dot com bubble, lots of internet companies went under.

What happened after was the greatest technology innovation in our life time.

I believe AI will be even bigger, resulting in opportunities few could fathom.

Those opportunities will come.

The best internet companies after the dot com bubble were trading at a fraction of their high flying prices.

Now they are the tech giants today.

Eric Chang

Pristina, Kosovo

October 14, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.