Most wealth is made during a volatile time

Best deals appear when people are scared

Most people associate volatility with risk.

And that’s true—to an extent.

But risk and opportunity are twins.

They always show up together.

During calm markets, everything looks predictable. Stocks go up slowly. Real estate prices climb steadily. Everyone feels like a genius.

That’s when the seeds of complacency are planted.

But when volatility hits, the opposite happens:

Fear replaces greed, prices swing wildly, and most investors pull their money to the sidelines.

That’s when the best deals appear.

When good assets get sold at bad prices.

The secret of great investors

Every major wealth-building story shares the same theme:

They made their biggest moves when everyone else was scared.

In 2008, when people dumped US real estate, a handful of investors bought prime properties for pennies on the dollar.

During the COVID crash, those who bought quality stocks at panic-level prices saw massive rebounds within a year.

After the dot-com bubble burst, companies like Amazon and Apple quietly rebuilt into the trillion-dollar giants they are today.

It’s easy to admire their courage in hindsight.

But in the moment, it never felt like courage.

It felt like chaos.

That’s what separates the crowd from the contrarians.

I wrote about living life as a contrarian here:

https://www.ecresearchgroup.com/p/why-i-travel-off-season-similar-to

The emotional side of volatility

The hardest part of investing isn’t analyzing numbers—it’s managing emotions.

Because when volatility strikes, logic takes a back seat and fear grabs the wheel.

People sell their best assets to feel “safe.”

They hoard cash while inflation quietly erodes its value.

They tell themselves they’ll “buy back in later”—but they rarely do.

Meanwhile, those who stay calm… quietly accumulate.

That’s when the biggest transfers of wealth happen:

From the impatient to the patient.

The golden lesson

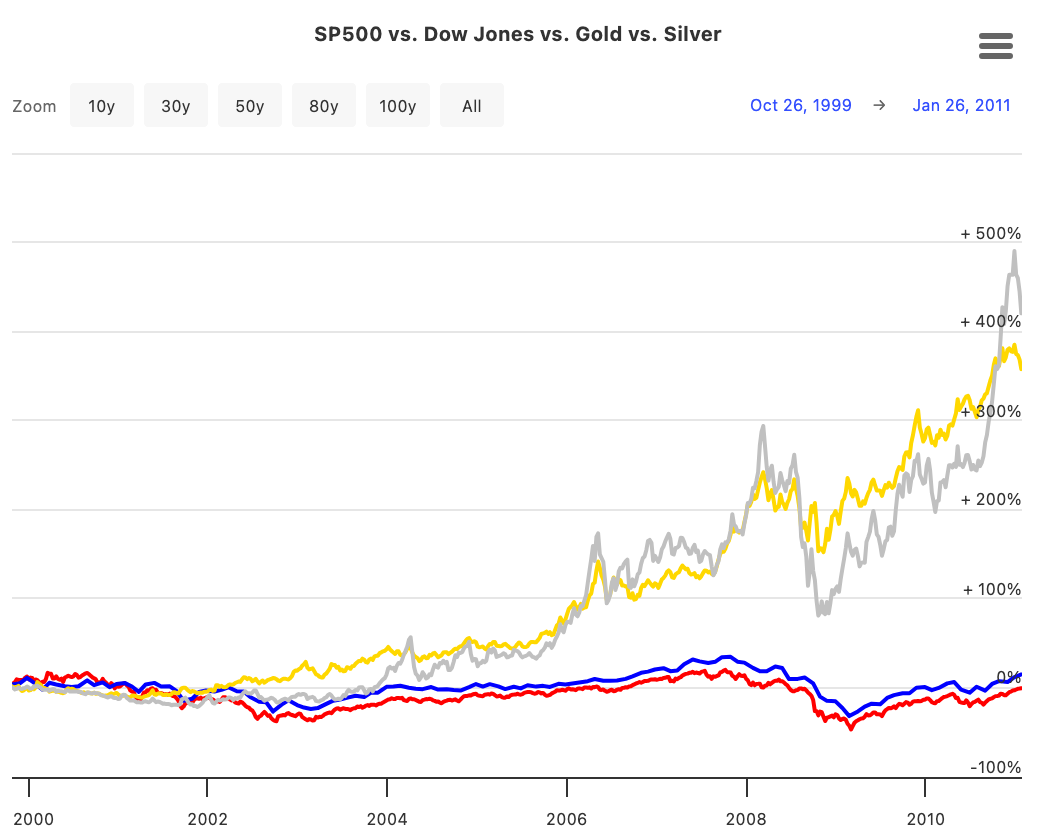

Let’s look at one simple data point:

During the last three major financial crises—

2000 dot-com bust

2008 global financial crisis

2020 COVID crash

Gold outperformed nearly every major asset class.

Between 2000 and 2011, while the S&P 500 barely moved, gold rose over 400%.

Source: longtermtrends.net

Even during the COVID panic of March 2020, when everything fell, gold recovered within weeks and went on to hit new all-time highs.

That’s not luck.

That’s what happens when investors seek stability in chaos.

Gold doesn’t create wealth out of thin air—it preserves it when others are losing theirs.

And for those who position early, it often multiplies as capital rushes toward safety.

Final thought

When the winds change, most people hide below deck.

The few who adjust their sails—who study the wind, stay calm, and act decisively—come out ahead.

Calm seas don’t make great sailors.

Volatility doesn’t destroy wealth—it transfers it.

The question is:

Are you watching the storm…

or learning how to sail through it?

Want to learn about how I’m using an advanced & low maintenance trading strategy to ride the gold bull cycle?

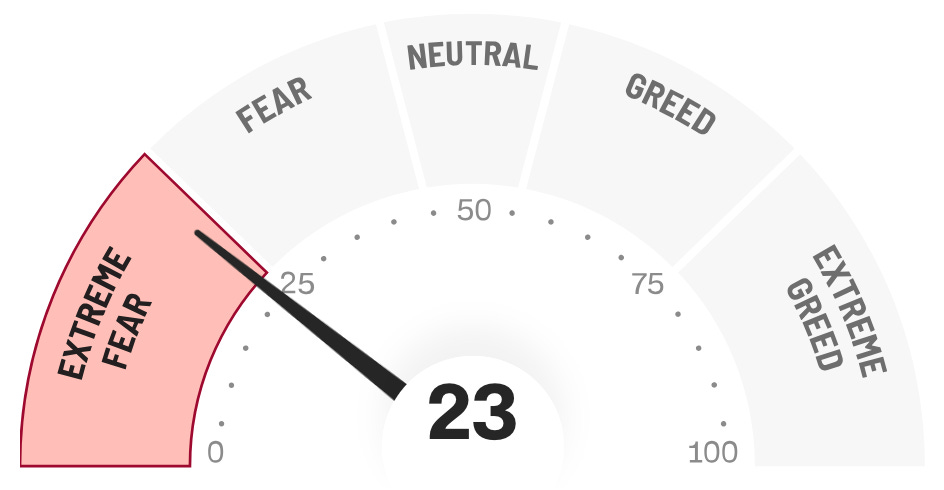

Investors are scared right now.

Source: CNN’s Fear & Greed Index

While this may be the sentiment, as a contrarian, I’m about to close out this year with one of the best years I’ve ever had trading only gold.

It pays to think differently!

This is a trading strategy I learned more than 10 years ago.

The strategy is ideal for people like myself who are running businesses full time while wanting to have control over how my capital is being invested.

If you’re interested to attend my next private zoom call, reply to this email.

If you like my work, I invite you to share it with others.

Eric Chang

Sarajevo, Bosnia and Herzegovina

November 4, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.