Never Say Never

The rent will NEVER go down

Welcome to EC Research Group Newsletter

Previously the Why Alberta Now Newsletter

We’re moving to a new name to better reflect on my whys of writing these newsletters:

Sharing unique market insights you won't hear in mainstream media.

No jargon. Critical thinking. Connecting the dots in plain English. Know what others do not.

Empowering busy investors in less than 10 minutes.

If you’re new, welcome!

If you’ve been following me for a while, thank you for reading.

I’m here because of the many emails I received from you.

Last week I was attending a workshop with a room full of emerging fund managers.

These are people who are working on launching their investment funds.

It's a room of many successful business operators who have had successes recently operating their businesses or deals.

They are now looking to start a fund for investors to invest in their projects.

While I respect and admire the optimism and confidence they have on their projects, as someone who is always on the look out for potential risks, I pay close attention to what many people are saying:

"The rent will NEVER go down in this area"

"We are secured and there's no RISK on getting the capital back"

"_____ asset has been the best performing asset in the past few years, it has limited supply, the price will KEEP going up as more and more people buying it"

I agreed with many of their investment thesis

Their thesis on why their investment projects / funds will go up makes a lot of sense to me.

I can see the potential and I agreed with them.

What made the conversations interesting was when the thesis got "flipped":

What may happen to your projects if ____________ happened?

What if ____________ causes investors to sell?

What are the ____________ risk of not getting the capital back?

Never say never

No one likes:

A devil's advocate

Someone who asks the difficult questions

Over the years, more money has been lost because of the belief that something is "never going to happen".

If you want to become a better investor and getting a better ROI on your investment, simply change this one approach, and you may see a better result:

Whenever you hear someone says ____________ will never happen, ask them:

What if it does?

Getting 20%+ in returns

Between 2023 & 2024, the S&P 500 returned more than 20% each year!

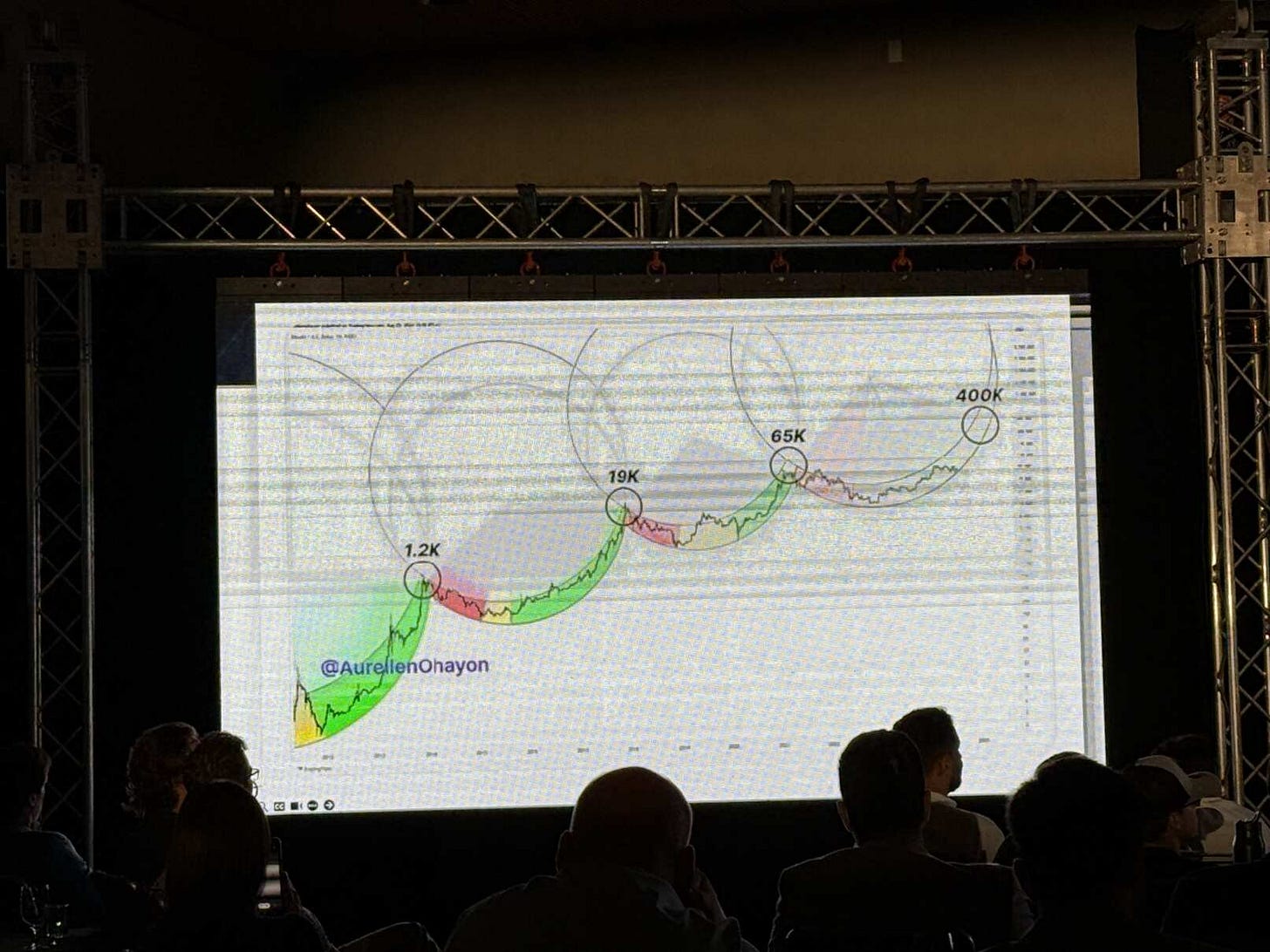

We have gone through the past 16 years - from 2009 to 2025 where the markets have been continuing going higher.

Yes, you could debate with me that we saw the market crash during COVID, 2022, and the recent tariff spook in April.

In the recent memory, every time the market "crashed," it has recovered quickly.

The longer term trend has been on a one way street: going up, up, up.

Could this up trend continue?

Absolutely.

However, there's a reason why the long term average returns for the stock market is around 10% / year.

While we have had a great 16 year run, there were also times in history where the market didn't go anywhere:

1966-82: 16 years

2000-13: 13 years

Last week we talked about the human nature that’s not very good at remembering things.

Recently the market is suggesting:

Trade war isn't an issue.

Russia / Ukraine war doesn't affect us.

Rising bond (interest) rate is back to historic normal rate.

It seems like it's Happy Hours everywhere.

Have a drink everyone!

I write this newsletter because I wanted the information I would want if our roles were reversed

Not trying to be a devil's advocate, a Debbie Downer, or one who asks the difficult questions.

I'm here to educate and inform.

I've seen first hand how one's life completely turned upside down after something "never was supposed to happen," happened:

My uncle had to stay working for many more years, all because he lost a significant net worth from the dot com bubble

An extended family member lost almost everything during the US housing crash in 2008

Many Canadian real estate investors got caught in the market correction in the past few years. Keep in mind, most markets didn't even "crash", it's down a bit. Yet, countless of projects are still dealing with the consequences today.

This is the type of education I would have wanted during the previous euphoric times, to see what's under the surface, while many are drinking the Kool-Aid.

Until then, cheers to markets recovering most of the losses from the April's tariff scare.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

June 17, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.