Opportunity is relative

A 461k successful case study

Last week, we went over a mistake investors make - when one views risk as fixed vs. relative.

If you missed it, check it out here:

https://www.ecresearchgroup.com/p/risk-is-relative

In this week's newsletter, let's explore the opposite side:

Opportunity is relative

Whether we like it or not, it's easy to fall into herd mentality.

It's how us humans are programmed.

Large part came from our adaptation to stay safe.

It makes sense, when one follows the crowd, it's hard to be targeted by a prey in the wild.

There has been countless study of how behavioral psychology affects how we invest or manage money.

When it comes to investing, herd mentality can cost you.

Our land flip / development project

Using our own project as a case study, we can see how opportunity is relative.

Over the past few years in Canadian real estate investing, development as a strategy became the hottest game in town.

Canada is in the middle of a housing crisis.

The huge influx of immigration over the past few years and the challenges in developing and building new inventories has resulted in a unprecedented supply and demand mismatch.

Whenever there's higher demand than supply, prices go up.

In the case of most municipalities in Canada, the demand significantly outstripped supply.

This creates a high demand for developing new buildings and adding inventories to the market.

Given there's a tremendous opportunity, money and investment flows to where it's treated best.

We’ve seen a record amount of capital flowing into developments.

Our simple and profitable land project

It was a simple profit model:

Purchase 3 side by side lots, combine them into 1 lot (called land assembly) and rezone it (called up-zone) to increase density, sell them to another developer to build once rezoning was complete.

Let's break down the numbers:

We purchased 3 properties.

Combined purchase price: $1,103,495

Sold price: $1,770,639

Expenses: $205,809

Net Profit: $461,335

The site area was 26,760 sqft.

Resulting a sale price / sqft at: $66 / sqft

With all in cost + purchase at: $49 / sqft

This project was sold at the end of 2024.

Just in time for a nice Christmas present for our investor partners.

Comparing this to another site

Recently, a site very similar to our site is listed on the market.

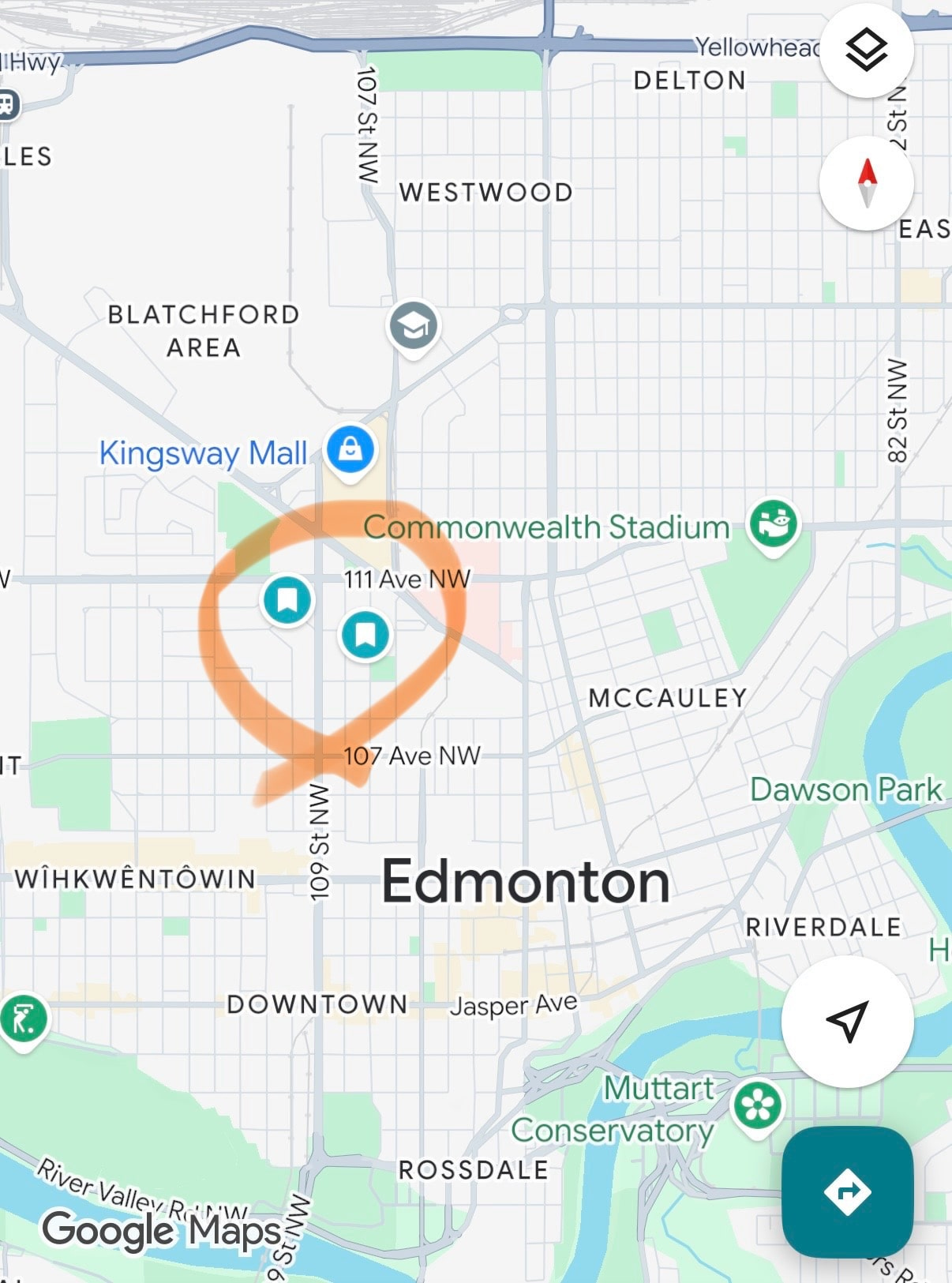

It's 500 meter (a little over quarter mile) from our site, or 7 min walking distance.

Look at the orange circle, the top left bookmark was our site, the newly listed site is on the bottom right.

This site is a bit smaller, at 22,500 sqft compared to ours at 26,760 sqft.

While a smaller sized lot will affect the size of the building that can be developed, usually the price won’t differ much when the size is that close between the two.

However, the price differs greatly - because of market conditions.

The asking price for the new lot?

$55 / sqft.

A very similar lot, yet priced at $11 / sqft lower than ours.

Why the difference?

Our lot was under contract back in May 2024.

The environment was very different back then:

Tariff wasn't an issue back then

CMHC had a lower insurance cost for a building that could be built there

The market was competing for lots to develop

In a little over a year, things changed.

While the Edmonton real estate market is still humming along, it's a different environment today than this time last year.

That means, the opportunity has also changed.

Just like what we talked about last week:

Risk isn't fixed, it's relative.

Opportunity also isn't fixed. It's also relative.

In this case, what’s the relative impact of the opportunity?

At $11 / sqft, we would had lowered our return by $294,360.

Ouch!

What a different Christmas story that would had been.

Even though development is the hottest game in town, a seemingly great opportunity is still relative to what’s happening in the market.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

July 29, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.