Prediction is a fool’s errand

That doesn’t stop me from giving it a try

On January 28, we’ll review my 2025 Economy & Market Predictions. You can register with this link below:

For years, I’ve been the “go to guy” for my family and friends when they want an opinion on where I think the market is going.

Before they bought real estate, they called me.

Before they invested in xyz, they called me.

When the market crashed, they called me.

I’ve been following the market and the macro economy for many years.

For the past few years, I’ve spent an average of 10 hours a week studying and tracking the economy and the markets.

It’s a topic I find deeply interesting.

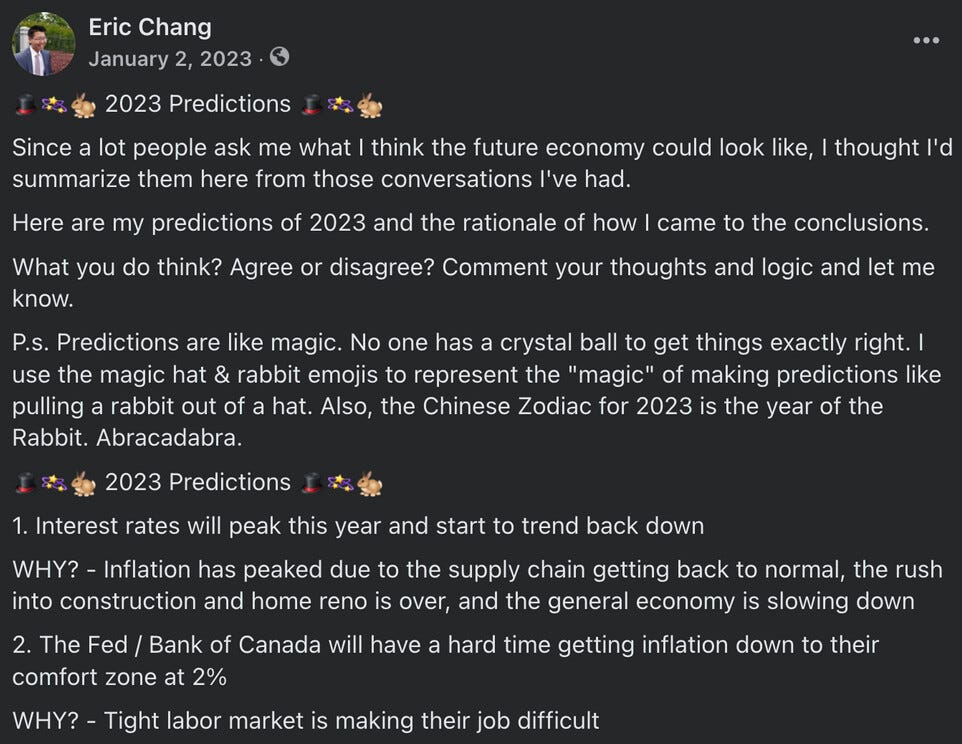

Since 2023, I’ve been sharing my annual Economy & Market predictions publicly.

What started as sharing research and data I was already doing for myself led to something unexpected.

One thing led to another, and I’ve now given presentations to hundreds of people on this topic — online and at private investor events.

Not because I have all the answers.

But because examining my thinking publicly sharpens it.

Prediction is a fool’s errand

Anyone who has been investing for a long time knows that making market predictions is a fool’s errand.

There are simply too many variables at play:

Central bank decisions that can shift sentiment overnight

Government policy changes, elections, and fiscal surprises

Geopolitical conflicts that erupt without warning

Technological breakthroughs that disrupt entire industries

Investor psychology swinging between fear and greed

Black swan events that nobody models for

Even when we “get it right,” hindsight often reveals that part of it was timing… and part of it was luck, and the rest is the actual experience.

Markets are complex adaptive systems.

They don’t move in straight lines.

That’s why prediction is so hard.

Why make a “fool” out of myself?

Few people like to make a fool out of themselves.

Putting predictions in writing, publicly, guarantees one thing:

Someone will remind you when you’re wrong.

So why do it?

I do this publicly to hold myself accountable.

It challenges me to go back and examine what I got wrong, and more importantly, why I got it wrong based on the logic I used at the time.

Because I don’t have a crystal ball, it’s impossible to be 100% right.

What I’ve noticed, though, is that I learn an enormous amount from reviewing how the dots were connected, and how they should have been connected differently.

It’s a challenging process.

And interestingly, it’s also quite fun.

The benefit is significant: it directly translates into better investing decisions.

And better decisions, when executed properly, can result in handsome payoffs.

Not every opportunity is investable

Investing is difficult because it’s a constant tug-of-war between emotion, logic, and intuition.

We’ve written about logic and intuition before here:

https://www.ecresearchgroup.com/p/logic-vs-intuition

Money is deeply emotional.

Because it’s tied to very different things for each of us:

To some, it represents security, power, or control

To others, it’s enjoyment, lifestyle, or freedom

And to some, it’s status, validation, or self-worth

Emotion is a big one to navigate.

Left unchecked, it’s usually the most expensive one.

Next comes logic and intuition - two sides of the same coin:

Identifying the right trend: sometimes an uptrend is just a “fake out,” where momentum fades and reverses

Finding the right asset (the vehicle) to ride the wave (market): not all assets benefit equally from the same trend, and some carry risks that only show up once conditions change.

Knowing the entry: paying too much can ruin a good idea, how to scale into a position or asset class

Knowing when to exit: staying too long can turn a win into a loss; cashing out too early leaves too much money on the table; exiting right is usually much harder than entering

We don’t write much about intuition because there’s not much to write about.

It often sounds like:

“This feels like 1999 again.”

“This feels like a bubble.”

“This feels like it could pop soon.”

The people who lived through those cycles are usually the ones with the sharpest intuition.

That said, since 2023, I’ve performed “above average”.

Not a bad shooting percentage

Let’s be clear: this isn’t perfection.

For the 2023 Economy & Market predictions, I missed two.

For 2024, out of the 10 predictions, I got six right and three partially right.

Pretty good if you were to ask me.

On January 28, I’ll once again put myself under the microscope and publicly review how I performed with my 2025 predictions:

If you’re interested in attending, not just to see what was right or wrong, but why those mistakes were made based on the logic laid out at the beginning of 2025, this is a Zoom call you won’t want to miss.

By learning from mistakes, we become stronger and better investors.

After all, doing well in the coming years will require foresight: the ability to see where the world is going, and to skate to where the puck is going.

Prediction may be a fool’s errand.

The real edge is being prepared when others are not.

Click here to register - Review of 2025 Economy & Market Predictions

If you like my work, I invite you to share it with others.

Eric Chang

Lethbridge, Alberta, Canada

January 20, 2026

Copyright © 2026 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.