Slowing Speed Ahead

Soft data keeps getting “softer”

Last week, I revealed the new brand that will be replacing Why Alberta Now:

EC Research Group

If you missed the announcement, you can read it here:

For the past few weeks, I have been warning about the slow down of US economy.

One may say, the “data” is showing the economy is doing fine.

What I have been talking about, is looking at “data” from another angle:

I’ve been focusing on forward projections, connecting the dots based on the recent policy changes in the US administration.

The economists call these “soft data” vs. “hard data”

Soft data reflects opinions, sentiments, and expectations, often collected through surveys, interviews, and other methods.

Hard data are objective, factual information that can be quantified and verified, such as GDP, unemployment rates, or retail sales figures.

One of the reasons why the Federal Reserve, Bank of Canada or many economists tend to “miss” things in the economy or commonly referred to as “being behind”, is because it takes time for the actual metrics to show up in hard data.

In an article published by the Federal Reserve Bank of St. Louis:

You'll hear people arguing about whether we're in a recession because the NBER doesn't often declare a recession until well after it has begun: The NBER uses data that are backward looking, so it takes time for the NBER to analyze all the data and make a judgment. Sometimes it doesn't make the call until after a recession has already ended. For example, the recessions of 1991 and 2020 were both relatively short and had already ended by the time the NBER announced the beginning date of the recession. Likewise, the economy is often well into the next expansion by the time the NBER calls the end of the last recession. For example, the NBER made the announcement that the COVID-19 recession ended April 2020 on July 19, 2021

Why many economists aren’t wealthy

This is one of the reasons I believe why few economists are truly wealthy.

Those economists who studies the hard data, are always looking from the rear view mirror.

Where a seasoned investor looks forward through the windshield to see what’s ahead.

That means, most of the time, the hard data economists will always be behind the eight ball.

That also means, a seasoned investor needs to make educated guesses on where the economy is heading toward.

This is also the reason why I find investing so interesting and challenging:

It’s much tougher to guess what’s coming around the corner than staring back at what has already happened.

Soft data keeps getting “softer”

The data I’m looking at, the “soft data,” keep showing up weaker and weaker.

Signalling the economy is continuing on a slow down trajectory.

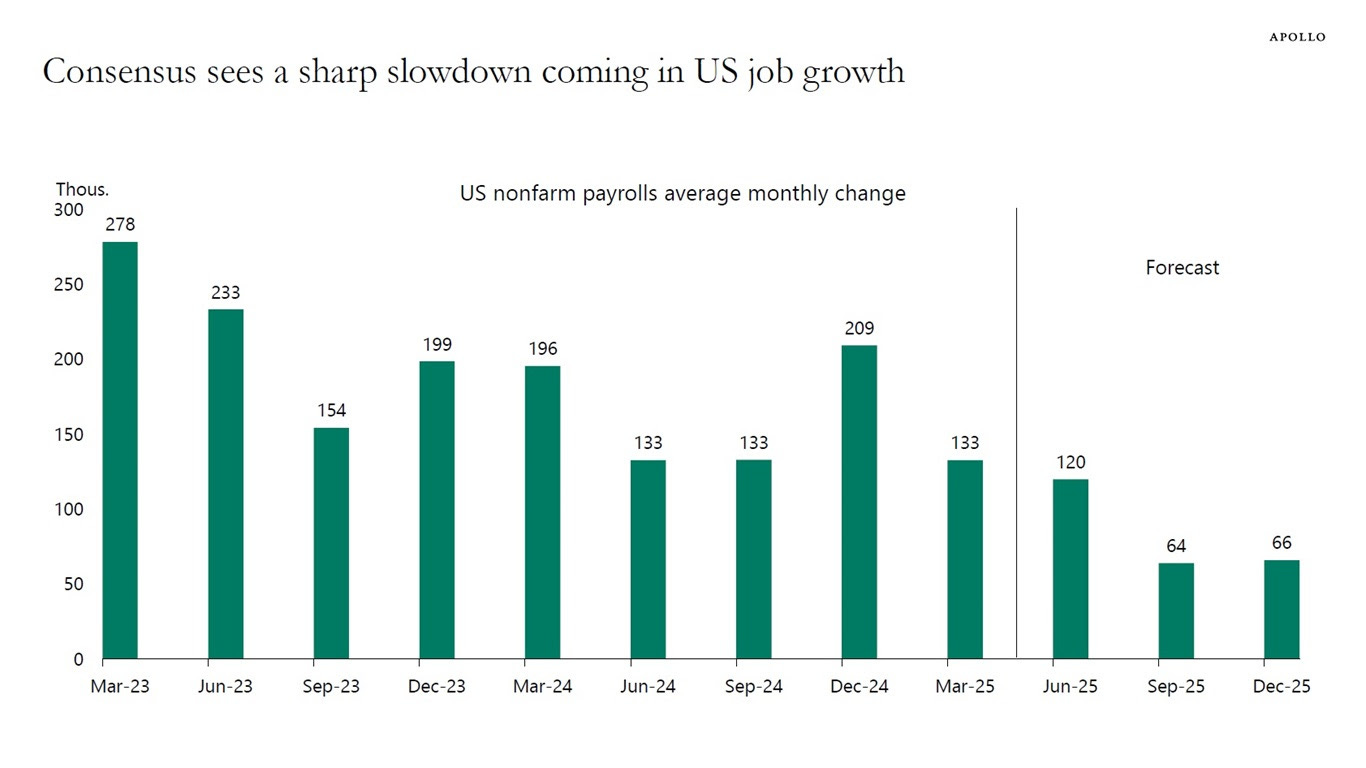

A recent chart from Apollo shows the forecast of US non-farm job growth in the coming months.

It’s showing a significant decline in growth compared to where we have experienced since the massive stimulus that was unleashed during COVID.

Will this turn into a recession?

One of the hallmarks of a recession is job losses and difficulty in finding jobs.

If you ask around, you will find that people are having a harder time finding jobs lately compared to couple years ago.

These aren’t scientific data points.

These are conversations I’ve had with retail workers, Uber drivers, small business owners.

There are plenty of other reasons to lead me to believe we’re on our way to a recession.

There will be direct consqeuences to any investor’s portfolio during a slower economy, whether it will be called a “recession” or not.

Keep an eye out for my upcoming workshop - Preparing for Recession

It’s been a busy time for me lately making moves and adjustments to my portfolio as I prepare for the potential down turn ahead.

I will be hosting a workshop on Preparing for Recession as a Real Estate Investor soon.

I don’t have the date yet.

If this is of interest to you, reply to this email and you will be the first to know.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta

June 3, 2025

Copyright © 2025 Why Alberta Now.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but Why Alberta Now does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. Why Alberta Now is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of Why Alberta Now. The content may be subject to change without notice and may become outdated over time. Why Alberta Now is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.