The election year playbook

US midterm money printing

If you’ve followed markets long enough, you start to notice patterns.

Not headlines.

Not narratives.

Patterns.

One of the most reliable patterns in modern markets?

Election years come with stimulus.

And 2026 is no exception.

In fact, based on what we presented during our 2026 Economy & Market Predictions webinar, this may be one of the most aggressive stimulus we’ve seen in years.

Let’s break down the playbook from the current US administration.

Governments don’t like recessions before elections

This isn’t political.

It’s the effect of the US democracy.

When American voters go to the polls in November, whichever Party is in power want:

Good GDP

Rising asset prices

Stable job numbers

Lower prices on everyday expenses

Confident consumers

One way to check off as many boxes above as possible, is through stimulus.

Today, the favorite tool in the toolbox is:

Deficit spending.

The first lever: Bigger tax refunds

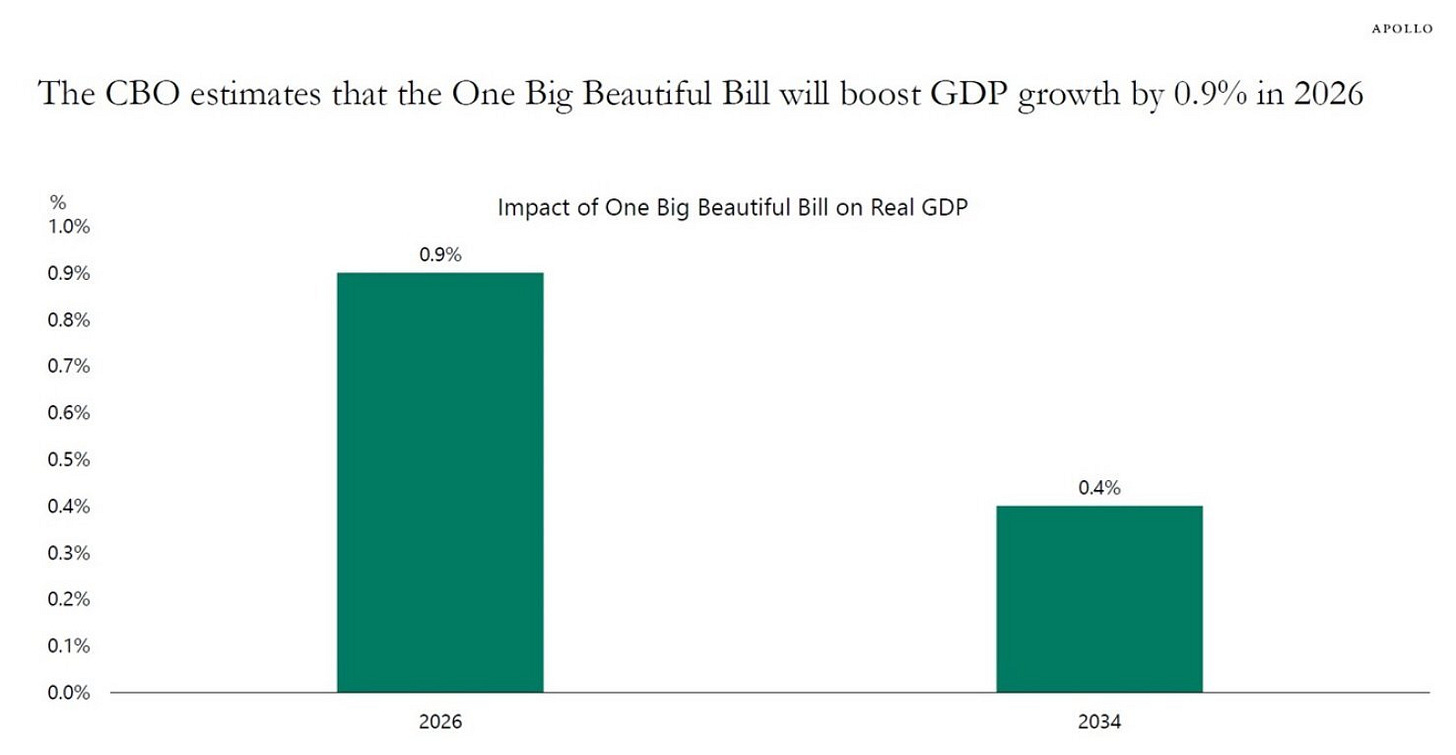

Source: Apollo

As suggested by the Congressional Budget Office, a nonpartisan agency, the “One Big Beautiful Bill” passed last year is projected to add roughly 0.9% to the GDP in 2026.

That’s enormous.

Goldman Sachs foretasted a 2.5% GDP growth for the US in 2026.

Almost 1% of that is being engineered through the tax policy.

Even more interesting?

The bulk of the stimulus will flow through in Q2 and Q3.

Right before midterms.

Coincidence?

Not at all.

It’s by design.

The second lever: Direct checks

There has been discussion of $2,000 per person stimulus payments funded through tariff collections.

A family of four could receive $8,000.

The administration is currently waiting on the US Supreme Court to rule on the legitimacy of the tariffs.

Even if the Court ruled against the administration, there will likely be tariff refunds and the tariff reversal would still push money back into the economy.

And when money enters the system quickly, it creates a temporary “wealth effect”.

The sudden influx of cash could flow into:

Consumption

Assets

Markets

Speculation

We saw this during COVID when the massive stimulus causing housing prices to skyrocket, rampant speculation into meme stocks, and overall stock market rose to record high.

The third lever: Interest rates

Normally, interest rate cuts only happen during recessions.

This cycle is different.

Government debt levels are so high that keeping rates elevated for too long becomes financially destructive.

It’s highly unusual to see rate cuts while the economy is still expanding.

But I believe it will happen this year.

Unfortunately, every time the politician has taken action to “help the little guys”, it usually hurting the very people they claimed to help.

While these short term stimulus may improve the mood of the voters going into November midterm election, the bulk of the stimulus will end up in the select few: the ones who own assets.

Big picture trend matters more than short term volatility

During the 2026 Economy and Market Predictions webinar, we discussed several major market trends that could fundamentally change the world as we know it.

We will be covering those “tectonic shifts” in our future newsletters.

In the mean time, if you are interested in catching the replay of the webinar, reply to this newsletter to request the link.

If you like my work, I invite you to share it with others.

Eric Chang

Cardston, Alberta, Canada

February 17, 2026

Copyright © 2026 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.