The Power of Asymmetrical Leveraged Trading

How to combine low risk with high reward

Yesterday, I hosted a zoom call on:

How to use an advanced, low maintenance trading strategy for the next gold bull cycle

The presentation was well received:

I introduced a system for investors who are looking to take advantage of the upcoming Gold run.

The system is designed to amplify returns while lowering risk:

2 seemingly contradictory objectives.

Yet, we showed the attendees exactly how it can be achieved using real estate as examples.

If you’ve been following this newsletter for a while, you know I’m always on the look out for opportunities where the upside outweighs the downside.

That’s the essence of Asymmetrical Leveraged Trading (ALT).

ALT combines two powerful principles into one framework:

Asymmetrical payoff – where potential gains far exceed potential losses

Leverage – amplify returns from the same amount of capital invested

When used together, these two ideas can transform the way we look at risk and reward.

What is an asymmetrical payoff?

An asymmetrical payoff means your potential upside is much greater than your downside.

Think of it as an investment where:

The upside probability is higher than the downside risk

The outcome gives you more profit than loss

In other words, you don’t need to win every time — you just need to structure your trades so that when you do win, it more than covers all your losses.

Real estate examples of asymmetry

Let’s look at a few examples from real estate to bring this to life.

Example 1: Same property, different interest rate

Setup: Wait to buy a single family property at the same price when interest rate is lower.

When interest rates drop, the mortgage payment goes down and your cash flow improves dramatically — without the property itself changing.

Downside: You own the same property.

Upside: Your cash flow increases significantly when rates fall.

Example: Even if nothing else changes, simply by going from negative cash flow to positive cash flow, making the risk of owning the property lower. This particular investment becomes asymmetrical — same property with much lower down side risk.

Example 2: Land development through rezoning

Setup: Buy land currently zoned for single-family or agricultural, but with potential to be rezoned for multifamily or mixed-use.

Downside: You’re holding the land at its current value.

Upside: If rezoned, the value could jump 2x–5x.

Example: For instance, 3 single family properties combined purchase price at $1.1M with RF1 zoning in Edmonton (Single Detached Residential) later sold for $1.77M after rezoned to RM h28 (Medium Scale Residential).

That’s the kind of asymmetry we look for — limited downside, amplified upside.

Adding leverage to the mix

If you’re a real estate investor, you already understand the power of leverage.

Let’s run a quick example:

Buy a $1M property with no leverage.

If it appreciates 10%, your return is 10%.Buy the same property with 80% loan-to-value (LTV) mortgage — you only invest $200K.

When it appreciates 10%, you make $100K profit on $200K invested = 50% return.Push it further with 95% LTV (5% down) mortgage.

The same 10% appreciation now gives a 200% return on your $50K down payment.

That’s leverage at work — magnifying the same upside while your out-of-pocket capital remains small.

When we combine the two

Here’s where the magic happens.

When you combine asymmetrical payoff + leverage, you get:

Lower potential risk

Potentially much higher return

This is the sweet spot of Asymmetrical Leveraged Trading.

The goal is to find opportunities that are extremely low risk but high probability — then use leverage to reap the rewards.

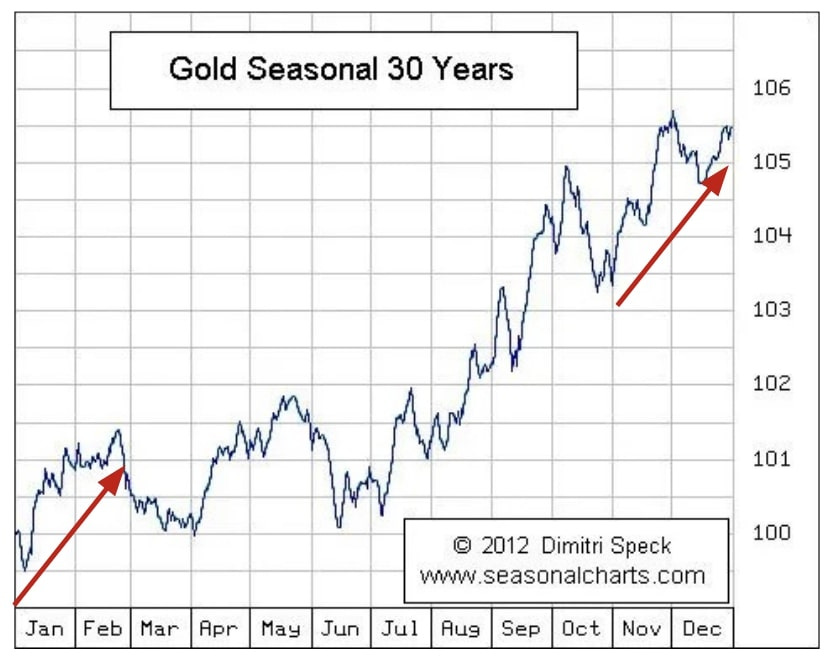

How we’re using Asymmetrical Leveraged Trading for the next Gold bull cycle

Asymmetrical opportunities don’t show up every day.

They appear when the market misprices risk and opportunity — when people see danger, and you see potential.

What Warren Buffett referred to as:

Be greedy when others are fearful.

That’s when you can apply ALT.

Right now, based on the macro economic conditions, I believe Gold is setting up for another run higher.

If you missed the zoom call, unfortunately, we hosted it live with no recording.

ALT is designed for busy professionals like you and me. There’s no day trading, no need to following the market daily. Follow the set up and wait for the right market condition and buy and hold just like you would owning real estate.

If you want to learn more about how we’re using ALT - Asymmetrical Leveraged Trading to capture an up sized potential return on the next gold cycle while managing the downside risk, reply to this email.

If you like my work, I invite you to share it with others.

Eric Chang

London, England

November 11, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.