War vs. Real Estate

A question I didn't give much thoughts before

Welcome to EC Research Group Newsletter

Previously the Why Alberta Now Newsletter

We’re moving to a new name to better reflect on my whys of writing these newsletters:

Sharing unique market insights you won't hear in mainstream media.

No jargon. Critical thinking. Connecting the dots in plain English. Know what others do not.

Empowering busy investors in less than 10 minutes.

If you’re new, welcome!

If you’ve been following me for a while, thank you for reading.

I’m here because of the many emails I received from you.

For the longest time, I thought I wouldn't have to consider the possibility of a major world conflict breaking out during my lifetime.

The story of my grandma escaping Communist China to Taiwan was simply - a story.

For one, she was very young when she boarded the boat leaving for Taiwan.

She didn't remember much as a young girl.

For me, as her grandson, listening to her telling her story, it seemed so foreign to me.

It sounded more like a fiction than a real life experience.

How could her story be real when we were sitting in a peaceful apartment in Tainan, Taiwan, while I was watching cartoons on Cartoon Network?

I brushed her off.

Almost forgotten.

Until the past few months.

Will WW3 breaks out?

There are signs pointing us toward that direction.

First it was Ukraine and Russia.

Then it was Israel and Palestine.

Pakistan and India almost got into a war.

And then most recently, Iran and Israel.

What will light the fuse for the next world wide conflict and when is anyone's guess.

On the flip side, there are also positive signs of de-escalations:

Pakistan and India de-escalated.

Iran and Israel's ceasefire may be holding up.

Researching into the impact of War on Real Estate

I’ve never given much thoughts to this topic before.

For starter, this was my first foray into researching the correlation between Wars and Real Estate.

I’m sharing the research I've done as I go.

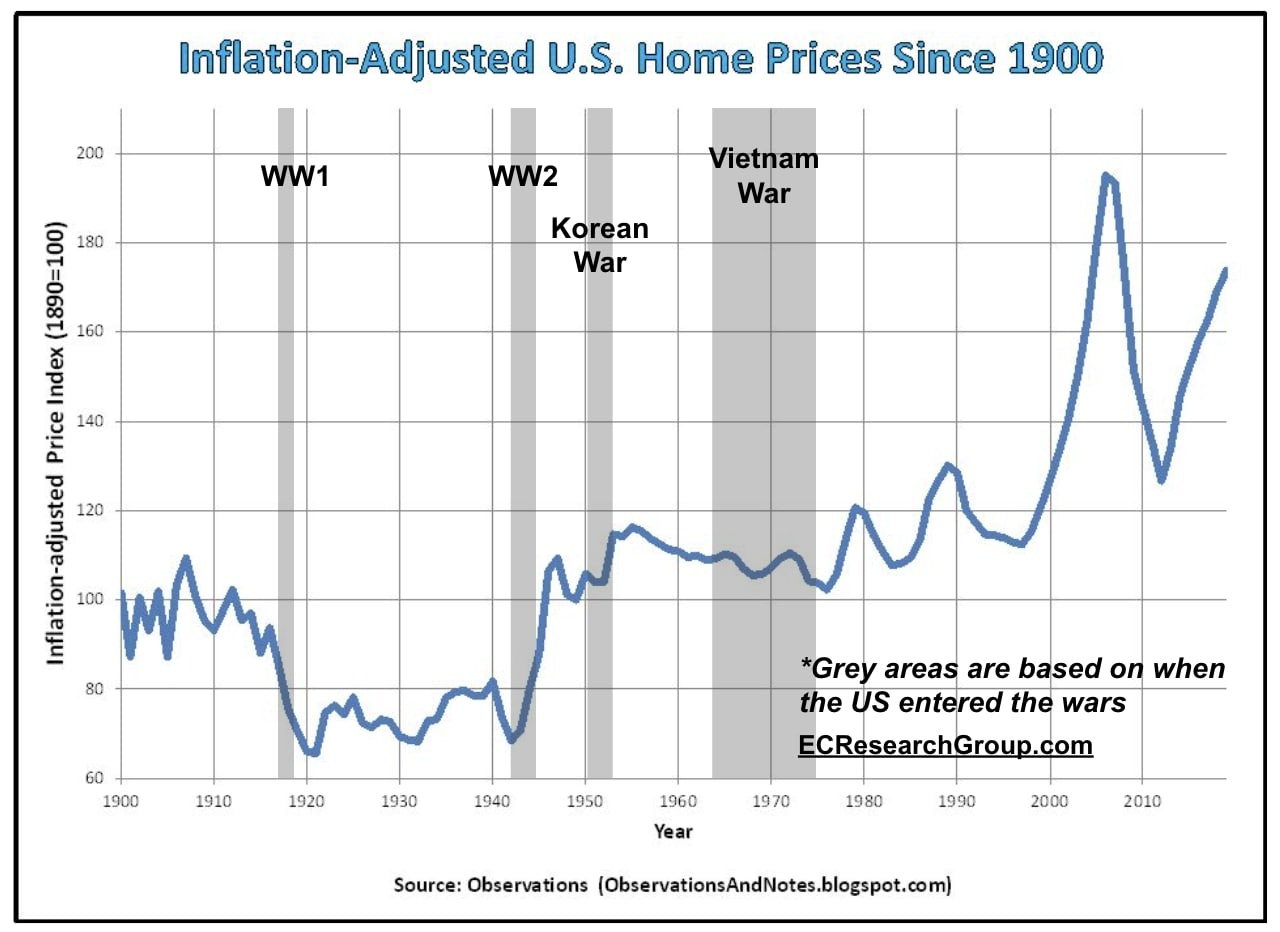

Here's a chart of the Inflation-Adjusted US Home Prices overlaid with the previous major Wars:

Let's look at the 4 major Wars with significant US casualties:

US housing market went down during WW1

When you trace the decline, you may notice that the decline started BEFORE WW1.

There's not a lot of data from 100 years ago.

I suspect the decline has more to do with the financial crisis "Panic of 1907" than the war itself.

During Vietnam War, the inflation-adjusted prices trended slightly lower

That was the time when inflation was sky high with interest rates around 10%!

Given that the chart showing the housing prices were mostly flat, it means the US home prices were mostly keeping up with the high inflation at the time.

One of the reasons why investors invest in real estate is to protect wealth against inflation.

We see that demonstrated clearly here.

The US real estate market actually went up during WW2 and Korean War

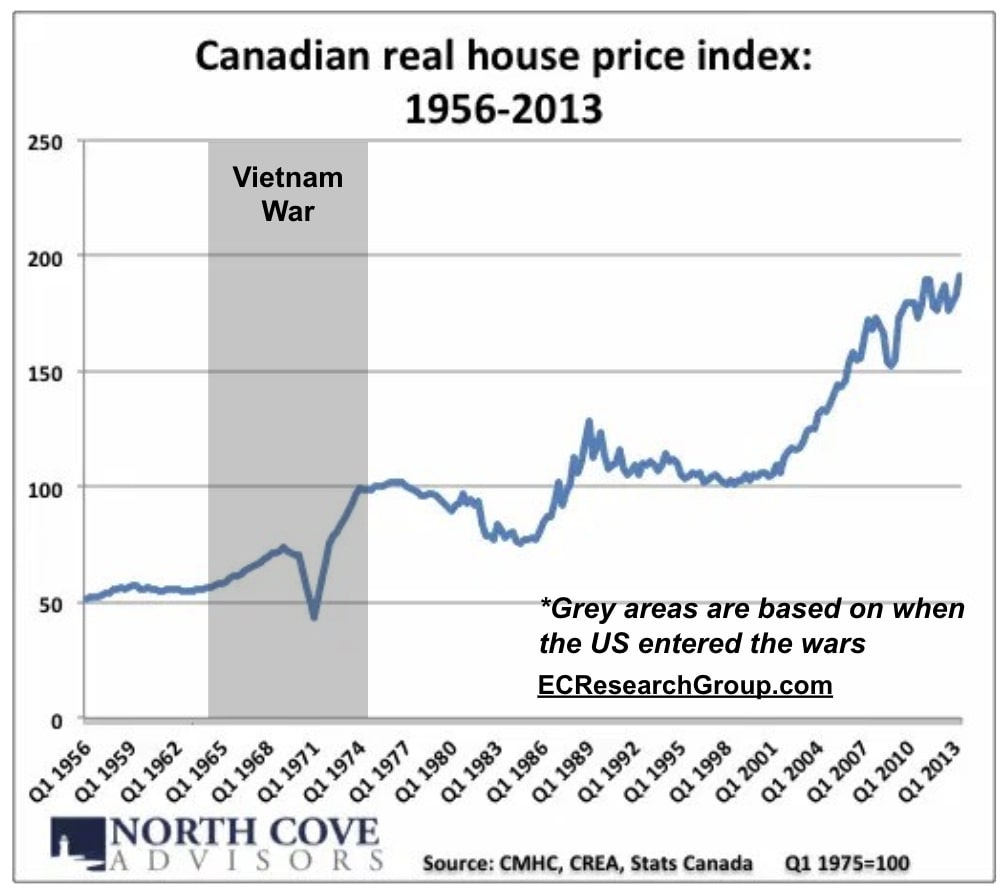

Canadian Real Estate chart

Here's a chart of Canadian Real Estate price index adjusted for inflation:

I couldn't find Canadian data going back to the 1900's.

If I were to take a guess, Canadian real estate may have performed similar to the US during the 2 World Wars.

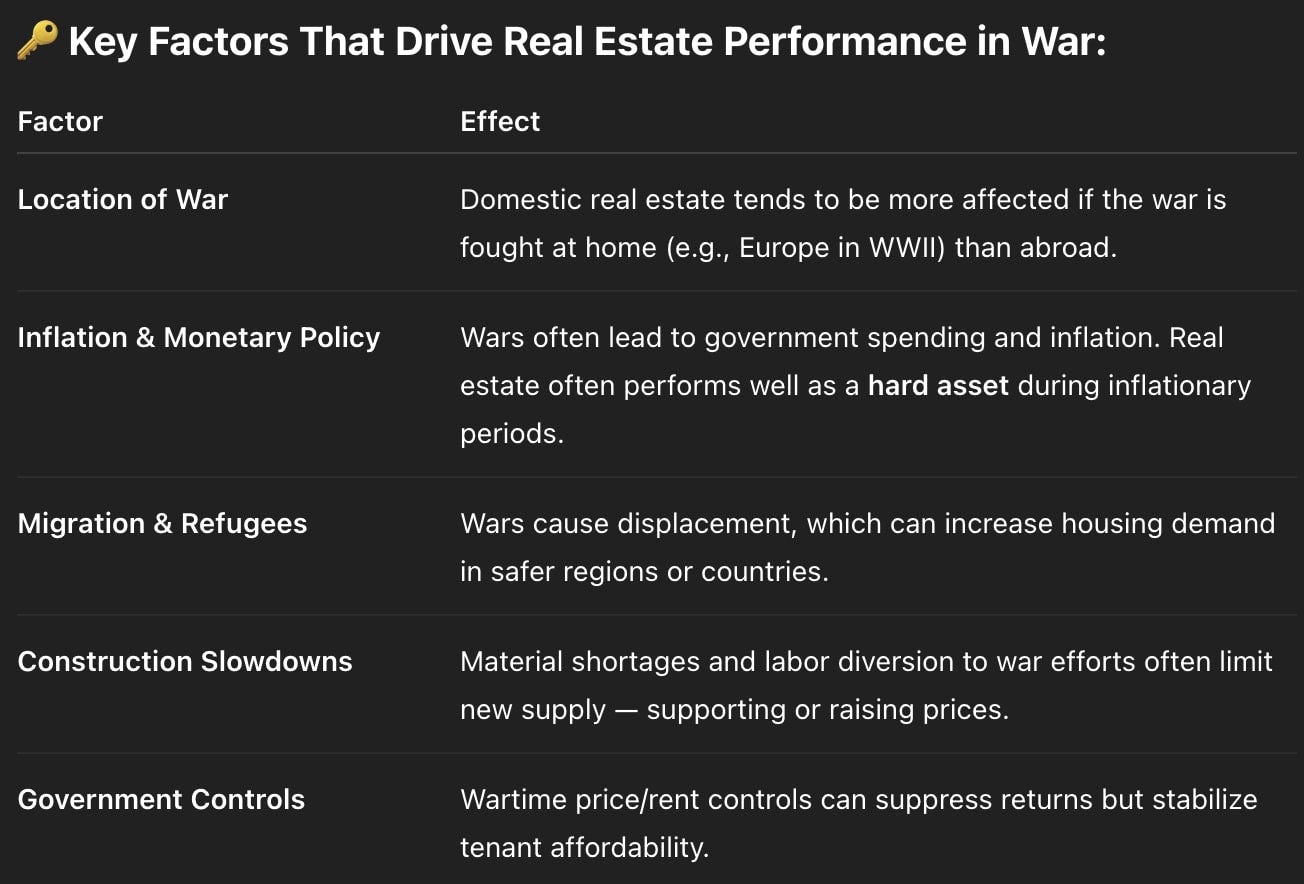

Key factors that drive Real Estate performance in War

Does that mean Real Estate prices are immune during a War?

Always remember:

Real estate is local.

Where the war is fought and inflation affect real estate more than the war itself.

We are fortunate to live in North America, where historically global wars were fought at a distance far away.

I used AI (ChatGPT) to summarize the various key factors here:

No amount of human lives lost are worth the justification of any wars

I'm a firm believer in finding peace and diplomatic solutions to resolving conflicts.

But I'm also not naive of human nature.

Wars are inevitable, because it often appears as the "only" approach to settle a conflict.

It is my prayer that the calm heads will prevail in the time of conflicts.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

June 24, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.