Why I travel off-season - similar to how I invest

And invest when others are scared

Have you ever had a breathtaking place all to yourself?

Picture this:

You walk into a waterfront restaurant, the kind that’s usually packed with tourists.

But today, it’s just you, the gentle sound of waves, and a view that feels like it was reserved for you alone.

The food tastes better, the service is warmer, and you can actually hear yourself think.

That’s why I love travelling off-season.

And it’s exactly how I approach investing.

When everyone else is crowding into the same “hot” destinations—whether it’s a city or an investment—I look for the places (and opportunities) they’re ignoring.

It’s not always comfortable.

Sometimes, it feels lonely.

Just like that empty restaurant, the rewards can be extraordinary.

Warren Buffett says it best:

“Be fearful when others are greedy, and greedy when others are fearful.”

It’s easy to follow the crowd.

It’s much harder—and often more rewarding—to go where others aren’t.

I’m currently on a workcation in the Balkans

If you aren’t familiar with a workcation, it is my favorite way to travel.

It works great in Europe.

I go visit sites during the day and then work during regular North American hours in the evening.

No loss of productivity while staying for an extended visit.

Recently I went to a restaurant recommended by a friend who I ran into at a bus station in Montenegro.

Out of 8 billion people on Earth, we happened to be at the same place, same time.

How remarkable!

Her recommendation was excellent - Divino:

https://maps.app.goo.gl/D3omucrCArwBKTxq7?g_st=ipc

The experience was spectacular:

Sitting next to the water on a serene day.

While waiting for the food to arrive, I was doing my best thinking:

Thinking about the big picture, future plans and strategies.

Moments like this are rare

During the busy tourism season, this place is packed with visitors.

Lots of noise, restaurants overflowing, boardwalk crowded with people.

Yet in just few weeks, it went from completely packed to almost empty.

This reminds me a lot on investing.

When an asset is “hot”, we see people rush in, chasing prices higher - just like everyone wanting a table at the 5-star restaurant.

Similar to tourism, investing has its own “seasons”.

Think like a contrarian

I don’t enjoy being a naysayer.

When people ask my opinion on an asset, I always give it honestly—even if it’s not what they want to hear.

Most people want agreement, but as a student of Warren Buffett, I’ve learned to always consider the other side:

Be fearful when others are greedy, and greedy when others are fearful.

To think differently from the crowd.

The uncomfortable truth in investing is that when everyone is making easy money, there are usually few real opportunities left.

Taking the opposite side isn’t easy, but the rewards are often much greater.

Similar to travelling off season, I get to enjoy a meal where I’m the only customer.

The chef’s entire focus was on preparing my meal.

I had the server’s full attention, no waiting for the bill (which, in Europe, can be a challenge!).

I connect with locals because there are so few tourists around.

There are so many benefits to travelling off-season.

A contrarian warning when others are “greedy”

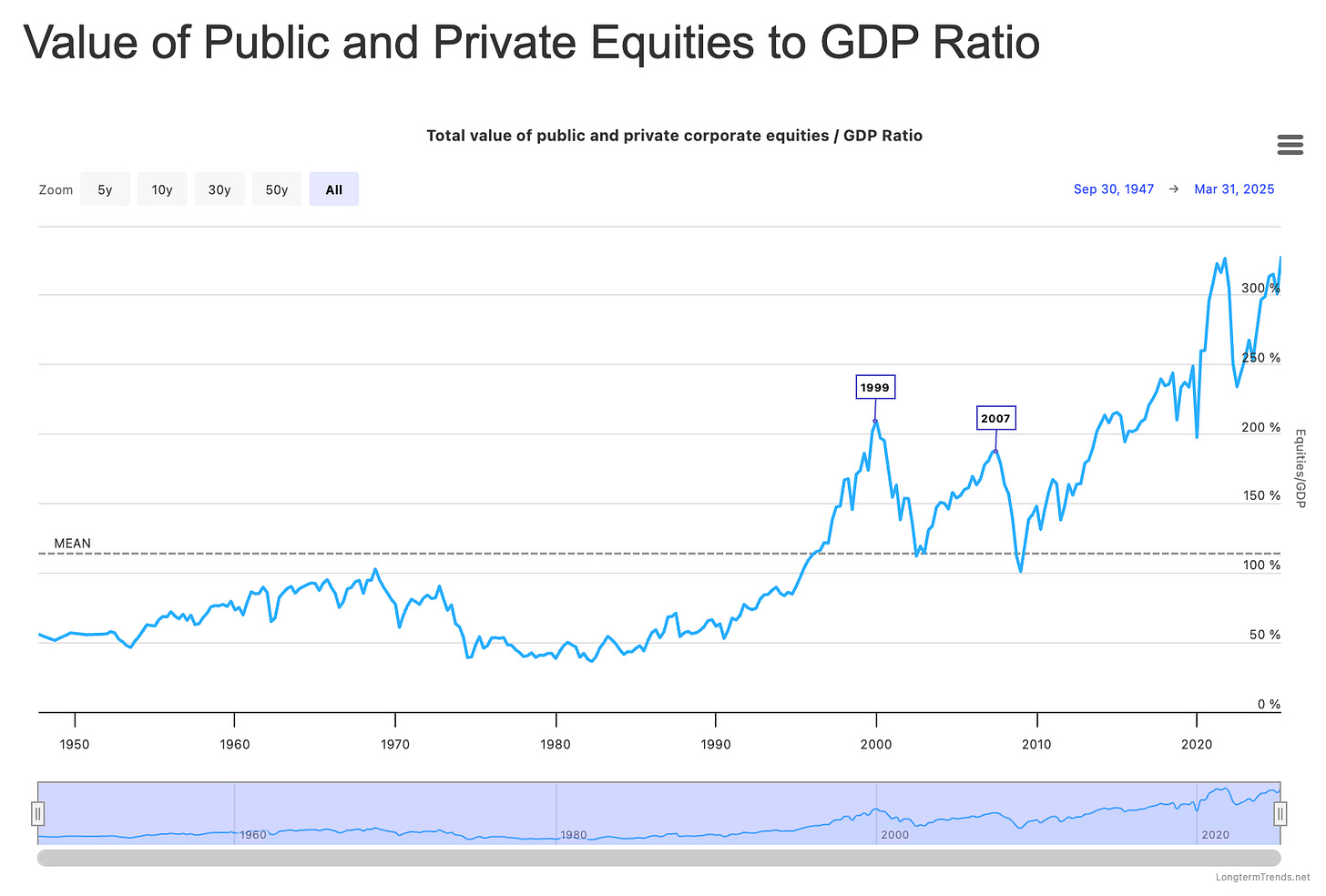

Here’s a simple chart that explains why I’ve been sounding the alarm:

Source: LongtermTrends.net

This chart shows the combined value of public and private companies compared to US GDP.

In other words, it measures how much investors are willing to pay for companies relative to the actual business activity in the economy.

When the line goes up, it means investors are betting that businesses are becoming more valuable than the underlying GDP growth—they’re paying more for future growth.

In a healthy environment, business expansion and GDP growth move together, and valuations stay relatively stable.

This results in a fairly flat line on this chart while the businesses are getting bigger.

But right now, business values are rising much faster than actual economic activity.

In fact, valuations are now at a record high—levels we haven’t seen since modern records began in 1947.

Can it go higher?

Anything is possible.

But it does make you wonder:

How far can it stretch?

There are only so many seats in a restaurant

At some point, we reach a tipping point—just like peak tourism season.

Eventually, the season changes.

Markets will always do what markets do best:

They shift.

Sooner or later, there will be only a few customers left in the restaurant, during the off-season.

That’s the time to travel.

That’s the time to buy assets.

What about you?

Have you ever taken a trip or made an investment when everyone else thought you were crazy?

Hit reply and tell me your story.

I’d love to hear how going against the crowd worked out for you.

Remember:

The best seats—and the best investments—are often found when everyone else has gone home.

If you like my work, I invite you to share it with others.

Eric Chang

Tivat, Montenegro

October 28, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.