Expect zero return on your stock portfolio

Positioning your portfolio as you're near retirement age

For the past few weeks, we’ve explored the power of diversification across Time Frames rather than just asset types.

If you missed it:

A real estate case study on time frame and total return:

https://www.ecresearchgroup.com/p/how-time-frame-impacts-our-portfolio

The full Time Frame Model for building diversified portfolios:

https://www.ecresearchgroup.com/p/investing-timeframe

Today, let’s look at why stocks may be one of the weakest mid-term investments over the next few years.

Before you hit that reply button and write:

Eric, but Stocks ALWAYS go up!!!

I’ll elaborate.

Why Stocks "always" go up

There are three forces that fuel this belief:

Inflation, economic growth, and investor psychology.

Why stocks go up #1 - inflation

Prices rise because the value of money declines.

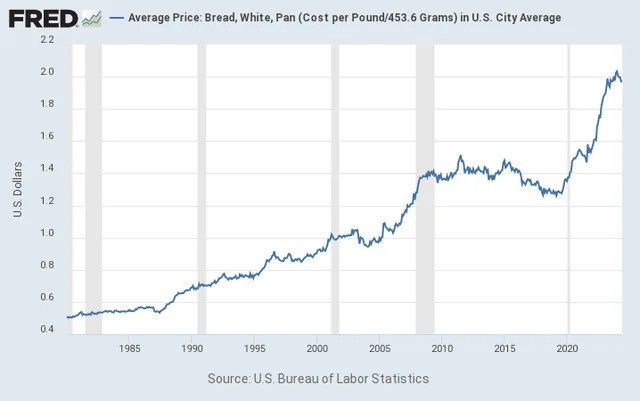

Take a look at this chart.

Credit: Federal Reserve

That is the price chart of an average loaf of bread.

A loaf of bread went from under 50 cents to over $2 in the past 45 years.

On paper, that’s 300% “appreciation,” or 6.67% per year.

But no one would call bread an investment- it goes moldy after a week.

Just because something appreciates in value, it doesn't make it "investable".

Otherwise, let's load up our portfolio in loafs and loafs of bread.

How's that for the greatest idea since sliced bread?

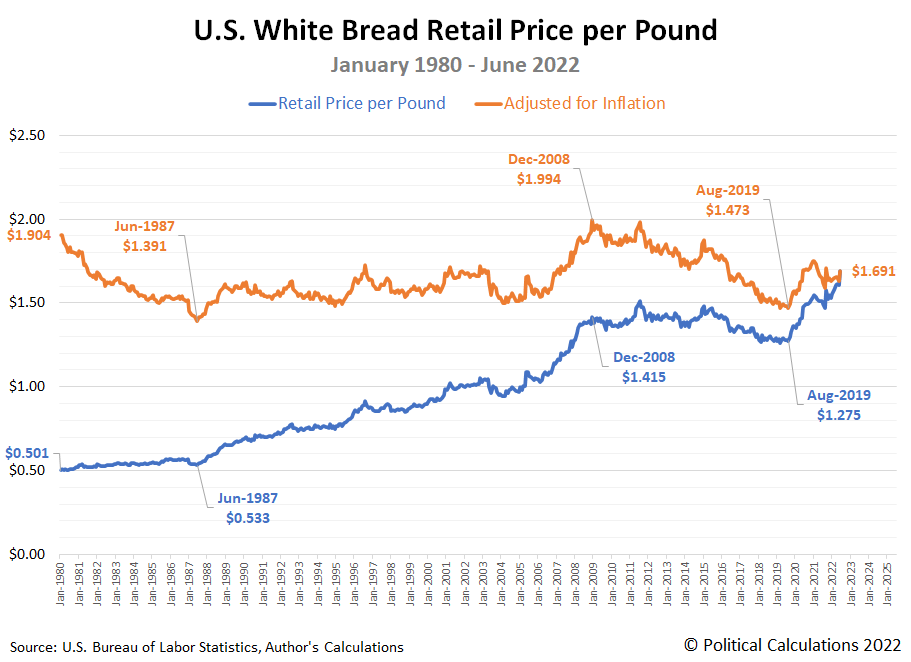

Credit: https://politicalcalculations.blogspot.com/2022/07/breadflation.html

This chart shows adjusted for inflation, the value of a loaf of bread remains essentially the same (orange line).

Why stocks go up #2 - Economic growth

Growing economies expand stock markets.

As companies earn more, their stock prices rise, and when many rise together, so does the market.

Excluding major geo-political tensions or society instability, the correlation between economic growth and stock market growth is high.

But growth is cyclical.

When expansion slows, or pauses, so does the stock market.

Why stocks go up #3 - Investor psychology

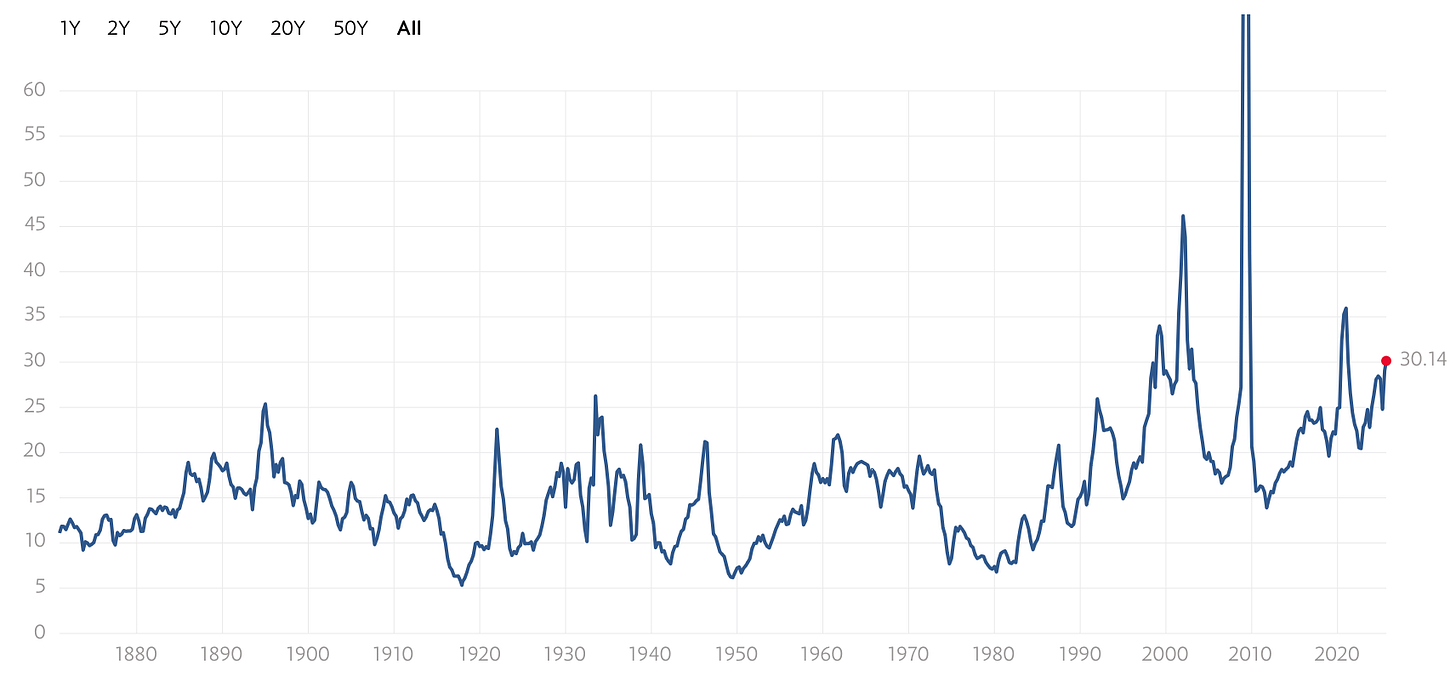

This shows up in valuation metrics, for example, the P/E ratio.

Otherwise known as Price Earning Ratio.

Right now, U.S. markets are priced at historic premiums.

That reflects extreme optimism:

Investors paying more for every dollar of earnings.

Credit: https://www.multpl.com/s-p-500-pe-ratio

Investors today are highly bullish that strong upside is ahead.

But ask most investors today why stocks deserve these premiums, the answers are thin.

Many are simply buying because “the market keeps going up.”

That’s not a strategy.

It’s herd mentality.

And when the herd turns, exits get crowded fast.

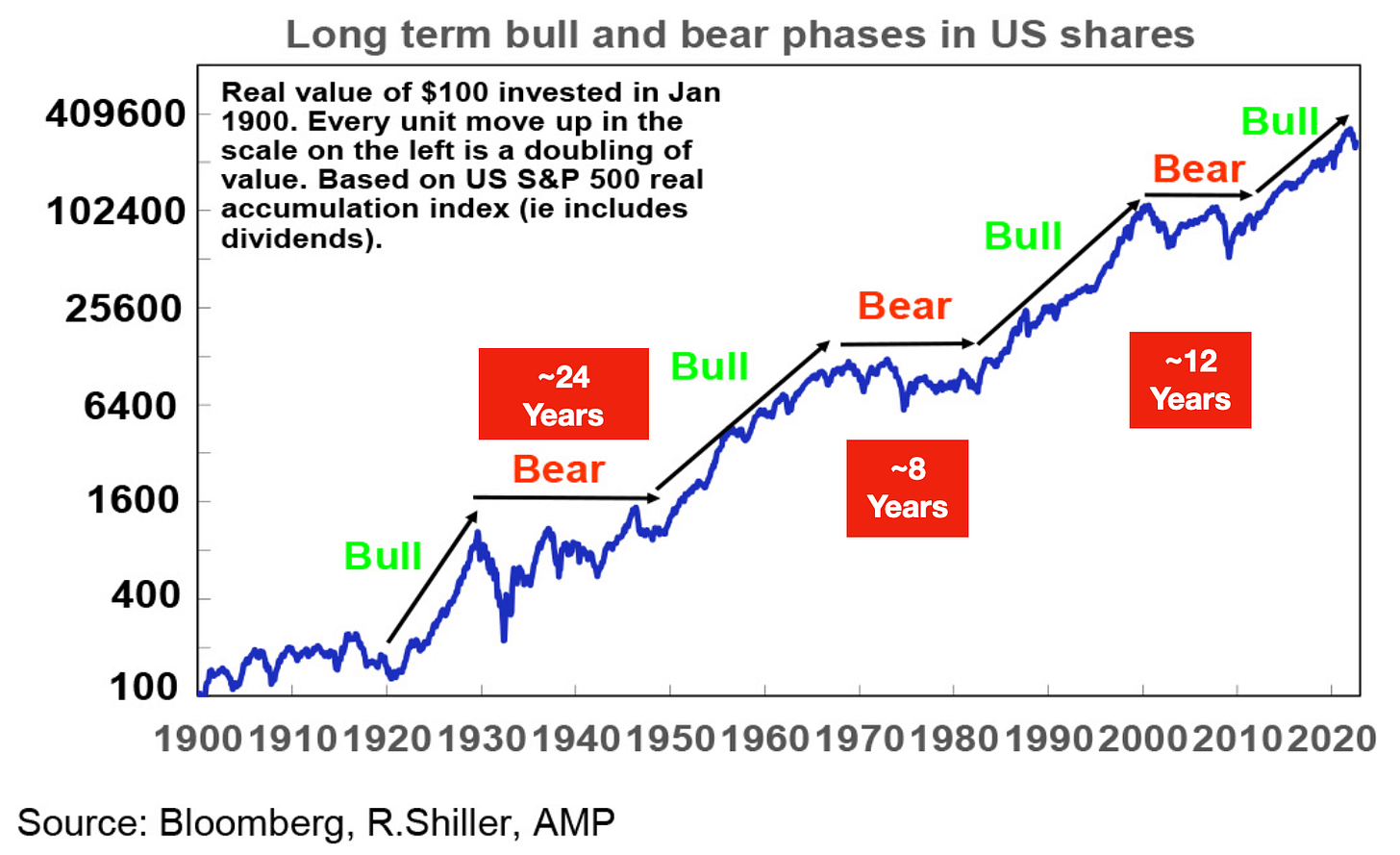

When stocks stayed flat for 10 years

History shows us long stretches where stocks stagnated for a decade or more.

The Great Depression left markets sideways for over 20 years.

More recently, there were 10-year windows with virtually no return.

Cycles repeat.

Today’s market shows signs of topping:

Short-term upside still possible, but mid-term risk is high.

If you are near retirement, mid-term Time Frame matters.

In the long run, stocks recover.

But the real question is:

How long are you willing to wait?

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

September 9, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.