Final thing before the holidays…

Remember what's the most important

I’m currently sitting in YYC, Calgary International Airport catching a flight to Toronto to visit families during the holidays.

While this newsletter has been primarily focused on finance and investing, I’d like to take this opportunity to refocus on why many of us do what we do.

To most people, we invest to put our money to work with the goals of having a comfortable retirement, providing for families, or leaving a legacy.

While I don’t want to speak for everyone, I think most would agree that we want the money we invested to work for us to buy back time, and give us more freedom and the ability to spend more quality time with the people we care and love.

I sent the following messages to my students in the ALT (Asymmetrical Leveraged Trading) program today.

Thought it’s fitting to share them with you as it applies to investing and life in general:

Final thing before the holidays…

The holiday period is known to have smaller trading volume.

The big Wall Street traders are on holidays.

Meaning the market could move more dramatic than usual because less people are trading it.

Do yourself a favor, once you’re positioned in those trades, put your phone and computer away and not look at your account for few days (even all the way to the new year).

It may feel uncomfortable, it could be some noise in the market that simply doesn’t even mean anything.

Take this time to be with friends and families

Enjoy the break and forget about trading.

After all, we trade to create income to give us more time and freedom to do what’s important - spend more quality time with the people we love.

Don’t let trading affect or ruin your holidays.

Trust me, this comes from someone who has traded for many years. It’s not worth the extra stress.

If you know that’s going to be on your mind the entire time, do yourself a favor and sell off some positions so you feel comfortable not having to look at the market every day.

All of these Example Trades are in anticipation of a nice pop in gold in the new year

If you are feeling anxious (which is normal when it comes to trading), it means you’re over leveraged.

May not be over leveraged financially, but emotionally.

An emotional tax on yourself is not worth any amount of money you could have made, especially during a holiday time when it’s meant for us to spend quality time with our families.

Sharing these thoughts for you as my gift 🎁 to all of you.

If you missed it

Our ALT (Asymmetrical Leveraged Trading) program will be completed in a month.

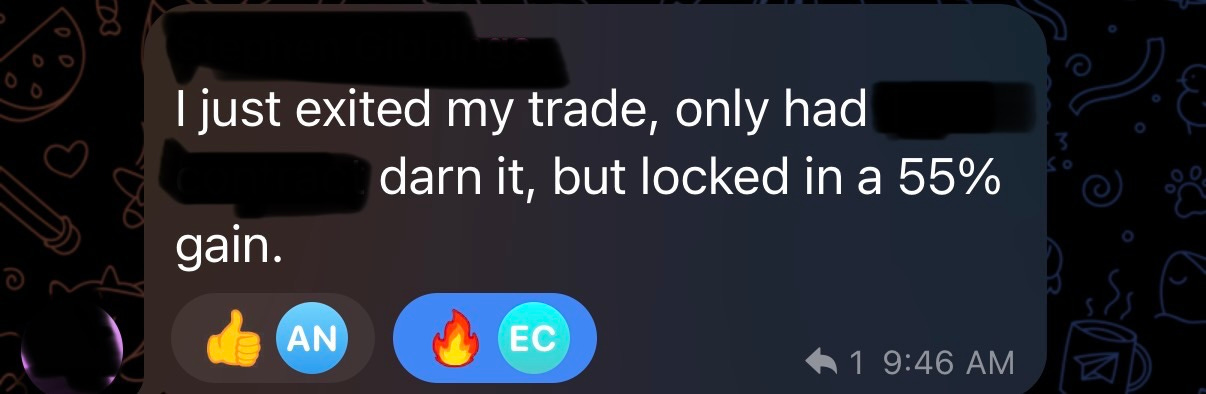

In less than 1 month, our results are as impressive as promised (if you attended our previous zoom call):

If you don’t know what ALT is, you can read about it here:

https://www.ecresearchgroup.com/p/the-power-of-asymmetrical-leveraged

Wishing everyone a great Christmas and holidays.

If you like my work, I invite you to share it with others.

Eric Chang

Calgary, Alberta, Canada

December 23, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.