Pros are selling, how about you?

Warren Buffett got this right before, you could have 1 year left to go

A reader shared his feedback after reading this issue - Never Say Never. You can read it here: https://ecresearchgroup.substack.com/p/never-say-never

Your experience and insight are always refreshing. Even though you do have a few years on me even in addition to that you’ve been doing this much much longer than I have.

I can confirm exactly what you’re getting at in this article as corroborated by a family office that manages over $100 million that invest more than six figures a month on market research and not only predicted but heavily capitalized on the 2008 crash.

They said the current environment is not sustainable so watch out.

Subscriber - R. K.

Yes, R. K. I believe we will continue to see the trend diverge between the caution expressed by the professional vs. retail investors.

This is the pattern at the end of every bull market cycle.

It happened during dot com bubble.

It happened during the US housing boom before the Great Recession.

It’s happening today again.

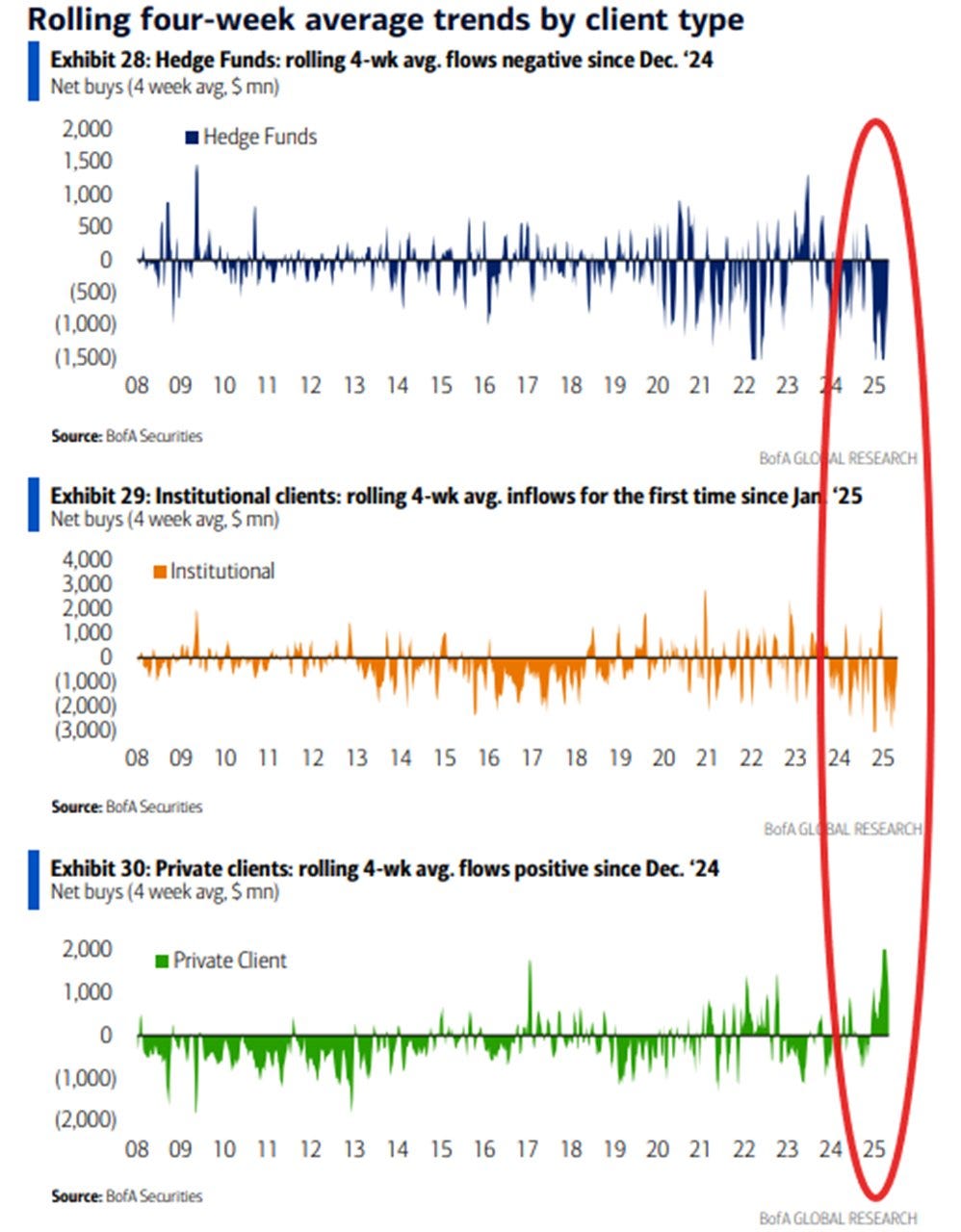

Today, we're seeing continued divergence between professional investors vs. retail or mom and pop investors

Look at the near record amount of capital inflow from retail investors - see the green areas under "Private clients".

Compare this to the near record selling from "Institutional clients" - the orange areas & "Hedge funds" - the blue areas.

Too much money chasing after deals don't make sense

In my recent meetings with people in the Edmonton multi-family real estate industry, a number of them expressed that there are too much capital from mom and pop looking to invest.

Driving up prices on some deals even though the fundamentals don't make sense.

Good deals are hard to find - said a multi-family broker.

This is fine if your investment time horizon is ultra long.

Then buying in at a high matters less over the long term.

This is also fine if one is well prepared when the market turns around.

What matters most is preparedness.

The benefit of owning physical asset such as Real Estate is that it will be around for a long time.

However, as I like to say:

Most Real Estate buildings will be around longer than the owners who own them.

Real estate will last.

Owners may not.

In the issue "Why professional investors are conservative with their money" we shared what some professional investors are doing with their portfolio

You can read the previous issue here: https://ecresearchgroup.substack.com/p/why-professional-investors-are-conservative

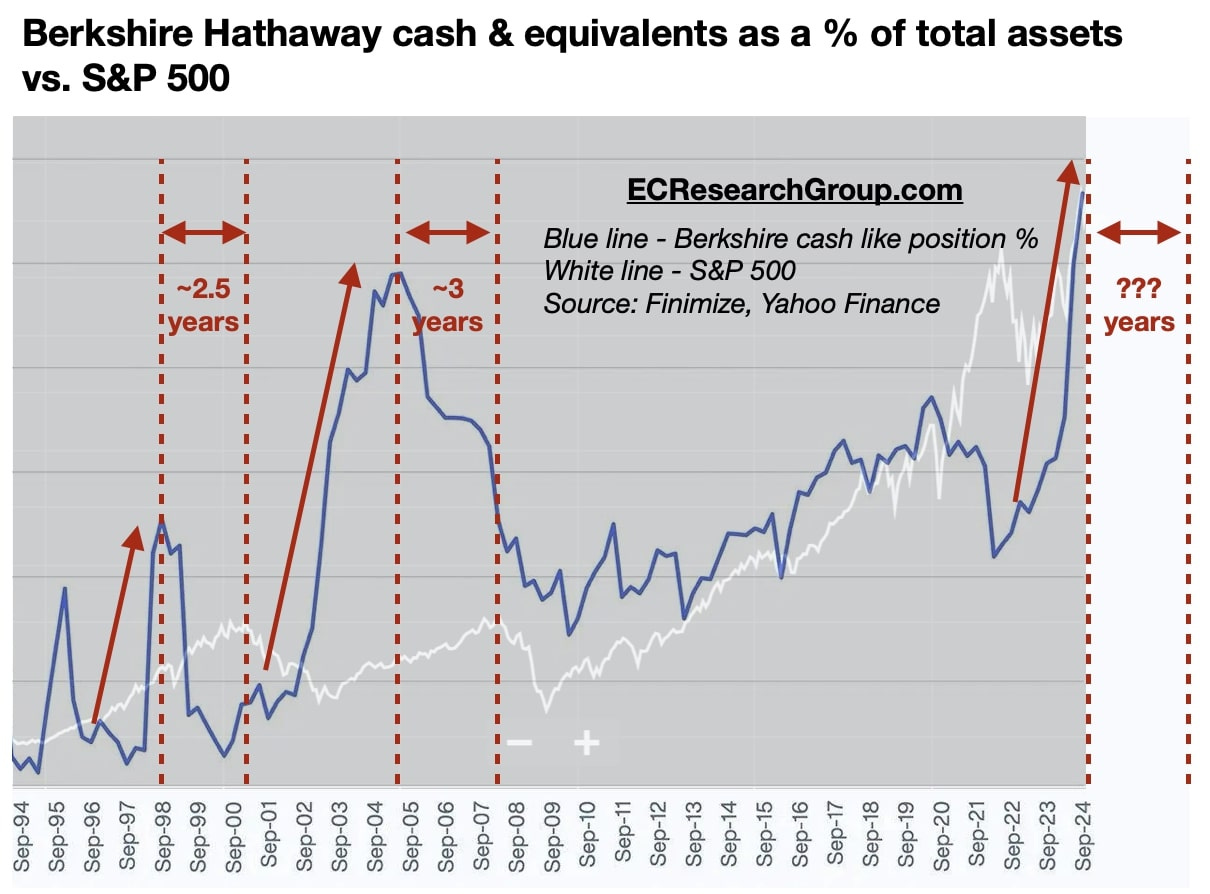

We mentioned how Warren Buffett has built a "financial fortress" over $300 billion dollars in cash like investments - Treasuries.

One thing I'd like to point out, is that Warren Buffett has always been early.

In the past whenever he (Berkshire Hathaway is his investment company) significantly increased his cash like position, he was early by 2 and a half to 3 years before the stock market ultimately crashed.

We are coming up in about a year since his recent boost in his cash like position, could this mean the market has about another year left to go?

Opportunity comes to the prepared mind - Charlie Munger

Charlie was Warren Buffett's long time business partner at Berkshire.

If Buffett is the face, Munger is the mind behind the curtain.

I like this quote from Nassim Taleb, the famed author who wrote "The Black Swan" a book focuses on the impact of rare and unpredictable outlier events:

Invest in preparedness, not in prediction.

None of us know when the market will turn, instead of trying to time the market, being prepared is the best way to take advantage of opportunities when they present themselves.

My partners have been hearing me talking about getting prepared for a while now

There's nothing to worry when the market changes tunes.

The market has been proven to be more resilient than many had expected.

Do you think the market will be turning soon?

Take the poll and let us know.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

July 15, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.