There's a reason they're lowering rates

Be careful what you wish for

The Fed and Bank of Canada’s next rate announcement is just around the corner.

If you have been reading my newsletter for a while, you may think I'm overly cautious in a up market that seems like the party will never end.

Before you think I'm a perma bear, who consistently predicts a market downturn, believing the market will crash or collapse, know that I'm a big believer in risk management.

That means, when the market makes sense, I jump in with both feet.

When it doesn’t, I either sit back or I look elsewhere for opportunities.

The previous market down turns shaped me into who I am today.

I've seen how a market cycle can wipe out someone's life savings:

My uncle.

Or 2008 US real estate housing crash:

My exchange student family's in the US and entrepreneur friends who lost everything or went under and needed to start over.

Managing the downside risk matters especially if one is closer to retirement.

What's more important is creating asymmetrical returns

What are asymmetrical returns?

These are the Holy Grail of investing. The unicorns.

An asymmetric trade or asymmetric payoff is when the outcome of a trade has more profit than loss or risk taken to achieve the profit. Or, the upside potential is greater than the downside loss.

Asymmetry of a trade may be when the downside is limited, but the upside is unlimited.

Or, if we are speaking of an asymmetric outcome, the upside profit was greater than the amount risked.

2021 asymmetrical risk / return in Alberta real estate

I went ALL in on Alberta real estate back in 2021 seeing a generational shift happening after years of sluggish real estate growth.

My thinking back then was simple:

First, the upside opportunity:

A low interest rate brought on by the Fed and Bank of Canada will push up real estate prices.

Interest expense is the highest cost owning real estate, when the input cost goes down, the price goes up.

Secondly, the money printing by the Fed and Bank of Canada will push up inflation. Real estate is a great place to be with higher inflation.

The downside risk was also lowered:

Compared with Ontario and BC, the starting price point made sense - Many properties cash flow at a normal rate environment (4-5%) compared with many properties in Ontario and BC where they didn't cash flow, investors were banking on appreciation as their only strategy.

Compared to Alberta, we could hold onto the properties and wait for appreciation to kick in higher.

Secondly, as the markets heated up in Ontario and BC, Alberta was significantly behind.

That "delta", the difference, made Alberta real estate even "safer" on a risk relative basis.

Putting the two together:

The upside created by the Fed and Bank of Canada would push up real estate (it happened).

The downside of a lower risk with cash flowing properties and a market that was already behind initially + a widening gap compared with Ontario and BC, made Alberta a much lower risk play (the aftermath of Ontario and BC’s market bust).

The combination?

A great asymmetrical risk / return play in Alberta real estate compared with Ontario and BC.

There's a reason they're lowering rates

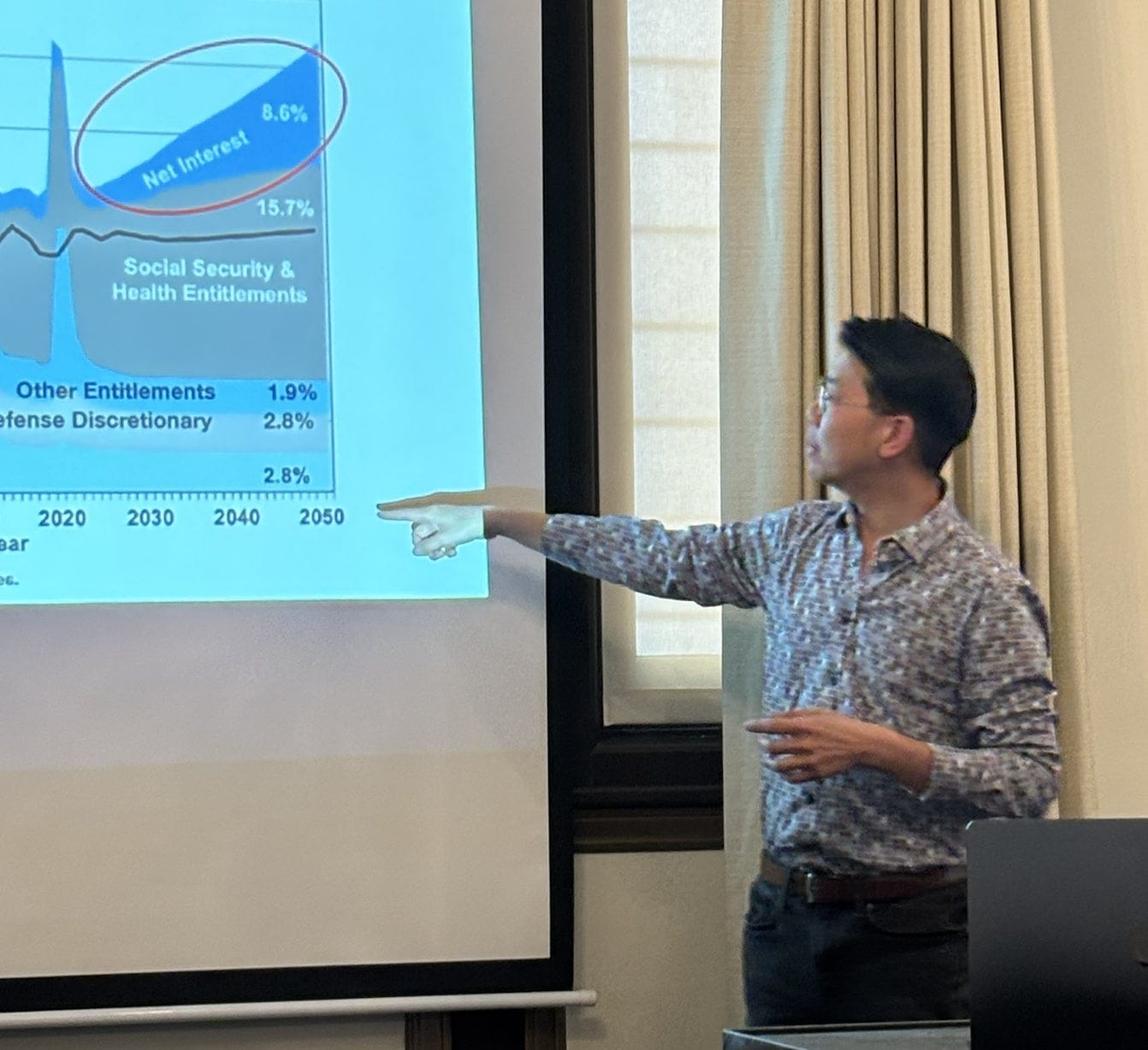

Ted Oakley with Oxbow Advisors, a money manager I follow shared his thoughts about where he sees risks today:

Is it possible that this massive flow of money will keep the market elevated for years regardless of what happens in the real economy?

Well, I don't think so. I think people have to remember I've been through a lot of these where the Fed starts lowering rates and the market goes down, because they wake up one day and say well there's a reason they're lowering rates things are slowing down so all these numbers are overpriced all these profit margins are too high all that starts to take place.

I'm not saying you couldn't have it go longer, because you can. You look at any of the bubbles of the past. Not just our country but Japan and different places, they can go on because that money can keep driving in. But you never know how long that goes.

My guess is that over the next 3 years or so, you're going to catch a firm, long-term peak in this stuff because the prices are so expensive. That you get to a point to where there's no return on what you're buying. And that's that's really what it mounts to in the long run.

Using the time frame portfolio model we've discussed over the past few weeks, he is concerned about the mid term, similar as I have shared here:

https://www.ecresearchgroup.com/p/expect-zero-return-on-your-stock

He is not alone.

Many professional money managers are expressing concerns about the market bubble we're in.

To me, high market prices is not the issue here

The issue to me is asymmetrical risk / return.

I'm having a hard time justifying the high amount of risk taken to produce the potential small returns in many stocks today.

Currently, there are few things that make sense to me from an asymmetrical risk / return perspective.

Except one.

In my opinion, there's 1 asset that has the most favorable asymmetrical risk / return combination going into 2026.

Early this year, I shared this asset with a private group of investors:

Since then, the asset has done exactly what I had predicted it would do:

Beating the average stock index by 3.4x, or even bitcoin by 2.2x.

Today, I just heard that another group of investors have expressed interest in wanting to learn more.

Thought I'd share it here if this is of interest to you.

Reply to this email and we'll send you the zoom link to attend.

If you like my work, I invite you to share it with others.

Eric Chang

Edmonton, Alberta, Canada

September 16, 2025

Copyright © 2025 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.