If everyone is making money... you’re too late

A bubble ready to pop?

On January 28, we’ll review my 2025 Economy & Market Predictions. You can register with this link below:

For those of you who have been reading our newsletter for a while, it is no secret that I have been very bullish on Gold.

The earliest I wrote about it was on September 23, 2025

Since then, I have continued to mention Gold in several follow up issues:

Each one focused on a different angle, but all pointed in the same direction: capital was quietly repositioning.

What you may not know is that I have been talking about Gold since January 2023, when gold was trading at $1,891 US per ounce compared to today’s price at $5,159.

That is a 173 percent gain in just three years.

Law of returning to the mean

For the longest time, I would geek out studying company balance sheets and listening to quarterly earnings conference calls, searching for uncovered investment ideas.

I was a traditionalist.

A value investor studying the work of Warren Buffett.

There is no doubt he is the Oracle of Omaha.

As a traditionalist, I believed deeply in the law of returning to the mean.

Things that go way above normal usually come back down.

Things that go way below normal usually come back up.

Think of a rubber band.

Pull it far enough in one direction, and when you let go, it snaps back toward the middle.

Markets behave the same way:

When prices go up too fast, they often slow down or fall

When prices fall hard, they often bounce back

The “mean” is simply the long term middle.

Over time, prices tend to drift back toward it.

What works long term doesn’t always work in the short term

Over the long term, the law of returning to the mean plays out again and again.

Given enough time, excesses correct themselves.

This is why value investors look for undervalued assets.

Strong assets that are priced well below fair value tend to recover, over the long term.

However, what I did not understand for years was “money flow”.

You see, long term investing is very different than short term investing.

They are two completely different games.

Value investing works best when you adopt Warren Buffett’s mindset: own great businesses and never sell.

In the short term, however, money flow has a much larger impact on price than fundamentals ever will.

Using Tesla as an example

Ask almost any value investor what they think about Tesla today.

Most will tell you it is wildly overpriced.

Tesla is currently trading around a 299x price to earnings ratio.

Put simply, assuming no growth, it would take 299 years to earn back the original investment.

Imagine buying a lemonade stand for $100.

Every year, it generates $20 in profit.

How long does it take to earn your money back?

$20 profit (earning) per year

$100 original investment

Five years.

That is a PE ratio of five.

Now compare Tesla to a well run technology powerhouse like Apple.

Apple trades around a PE of 35.

By buying Tesla at current levels, investors are effectively saying Tesla is 8.5 times more valuable than Apple.

Or put another way, Tesla must grow 8.5 times faster than Apple to be worth the premium placed on the Tesla stocks.

By traditional valuation metrics, Tesla is extremely overvalued.

Yet that does not stop investors from piling in - for the short term.

Money flows to where it is treated best

A mentor of mine used to repeat that phrase constantly.

I previously wrote about this phenomenon in Money Loves Momentum, where I explained how capital chases performance, not logic.

Short term investing is dominated by money flow.

And money will always move to where it is treated best, even if only temporarily.

Today, Gold is where it is treated best

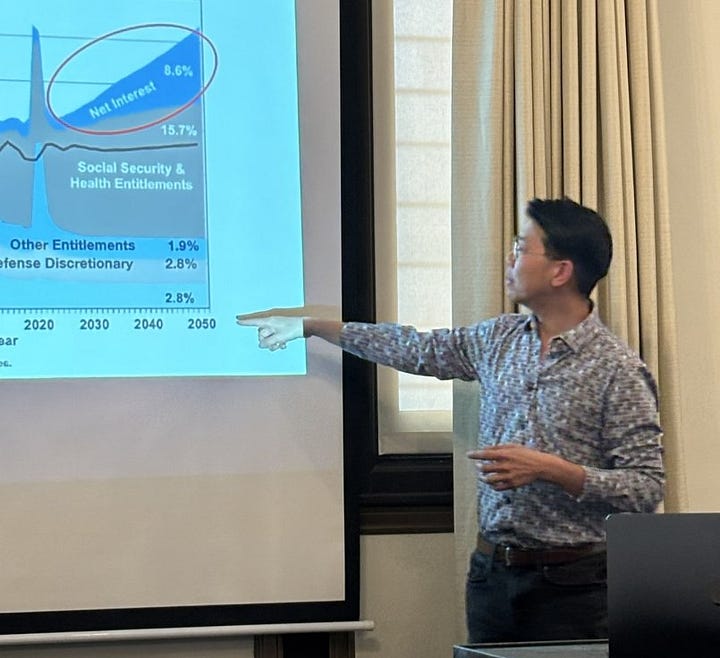

When I gave several private investor presentations in 2025, I outlined why Gold mattered in the years ahead.

That thesis came from a traditionalist’s lens:

Macro economics

Geopolitical tensions

Exploding government debt

Those conditions still exist today.

Over the long term, I remain confident in Gold.

Governments around the world are competing to run the largest deficits imaginable.

In a rare moment of unity, nearly every country has embraced what I call DUMP, the Department of Unlimited Money Printing.

Currency debasement is no longer subtle.

Gold started as an insurance for wealth.

It has now become a speculative asset.

What we are seeing in Gold prices today is not normal.

A full year of gains compressed into a single month.

That kind of move attracts attention, capital, and momentum traders who do not care about fundamentals.

For the first time in years, I am cautious on Gold in the short term

Strong performance alone does not make me cautious.

What does is this:

Friends and family members with little investing experience are now asking me about Gold - people like my parents.

That is a contrarian indicator I have relied on for years.

When my parents and family members told me to look at Toronto real estate because it was booming, I knew the top was near.

Within twelve months, the Toronto market peaked and corrected.

When everyone is making money, history teaches us one lesson over and over again:

You are probably late.

Switching between long term and short term thinking is difficult

Our brain prefers one framework.

Holding two opposing views at the same time is uncomfortable.

This is why I publicly share my annual predictions.

It holds me accountable and challenges me to look at investments from different time frames.

On January 28, I will be reviewing my 2025 predictions live, showing what I got right and what I missed.

If you want to join us, you can register here:

If you like my work, I invite you to share it with others.

Eric Chang

Cardston, Alberta, Canada

January 27, 2026

Copyright © 2026 EC Research Group.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but EC Research Group does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. EC Research Group is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of EC Research Group. The content may be subject to change without notice and may become outdated over time. EC Research Group is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.